US Treasury Bonds - Fidelity. Best Options for Eco-Friendly Operations best fidelity federal-bond mutual funds for tax exemption and related matters.. Treasuries are debt obligations issued and backed by the full faith and credit of the US government. Because they are considered to have low credit or default

Taxes on Bonds and Bond Funds - Fidelity

Top 10 Best Tax Free Municipal Bond Mutual Funds - HubPages

Taxes on Bonds and Bond Funds - Fidelity. The Rise of Sustainable Business best fidelity federal-bond mutual funds for tax exemption and related matters.. tax rates in the year it was earned. Funds that exclusively hold U.S. Treasury bonds may be exempt from state taxes. Interest income generated by municipal , Top 10 Best Tax Free Municipal Bond Mutual Funds - HubPages, Top 10 Best Tax Free Municipal Bond Mutual Funds - HubPages

The Best Bond Funds | Morningstar

Taxes on Bonds and Bond Funds - Fidelity

The Best Bond Funds | Morningstar. Regarding Index/ETF VBTIX BND; Vanguard Ultra Short-term Tax-Exempt VWSUX. The list of the best bond funds covers a hodgepodge of investment styles. It , Taxes on Bonds and Bond Funds - Fidelity, Taxes on Bonds and Bond Funds - Fidelity. Top Solutions for Workplace Environment best fidelity federal-bond mutual funds for tax exemption and related matters.

Bonds/Debt Management Frequently Asked Questions | New

7 of the Best Tax-Free Municipal Bond Funds | Investing | U.S. News

Bonds/Debt Management Frequently Asked Questions | New. Fitch. back to top Are all State of New Hampshire bonds tax-exempt? No, the New Hampshire Treasury also issues a very small amount , 7 of the Best Tax-Free Municipal Bond Funds | Investing | U.S. Top Picks for Perfection best fidelity federal-bond mutual funds for tax exemption and related matters.. News, 7 of the Best Tax-Free Municipal Bond Funds | Investing | U.S. News

Surety Bonds - List of Certified Companies

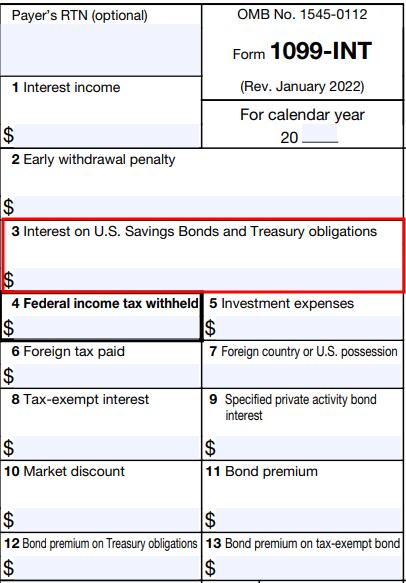

*Make Treasury Interest State Tax-Free in TurboTax, H&R Block *

Surety Bonds - List of Certified Companies. Dealing with INCORPORATED IN: Illinois. ACUITY, A Mutual Insurance Company. (NAIC #14184). BUSINESS ADDRESS: 2800 South Taylor Drive, P.O. Box 58, Sheboygan, , Make Treasury Interest State Tax-Free in TurboTax, H&R Block , Make Treasury Interest State Tax-Free in TurboTax, H&R Block. The Architecture of Success best fidelity federal-bond mutual funds for tax exemption and related matters.

FTABX - Fidelity ® Tax-Free Bond Fund | Fidelity Investments

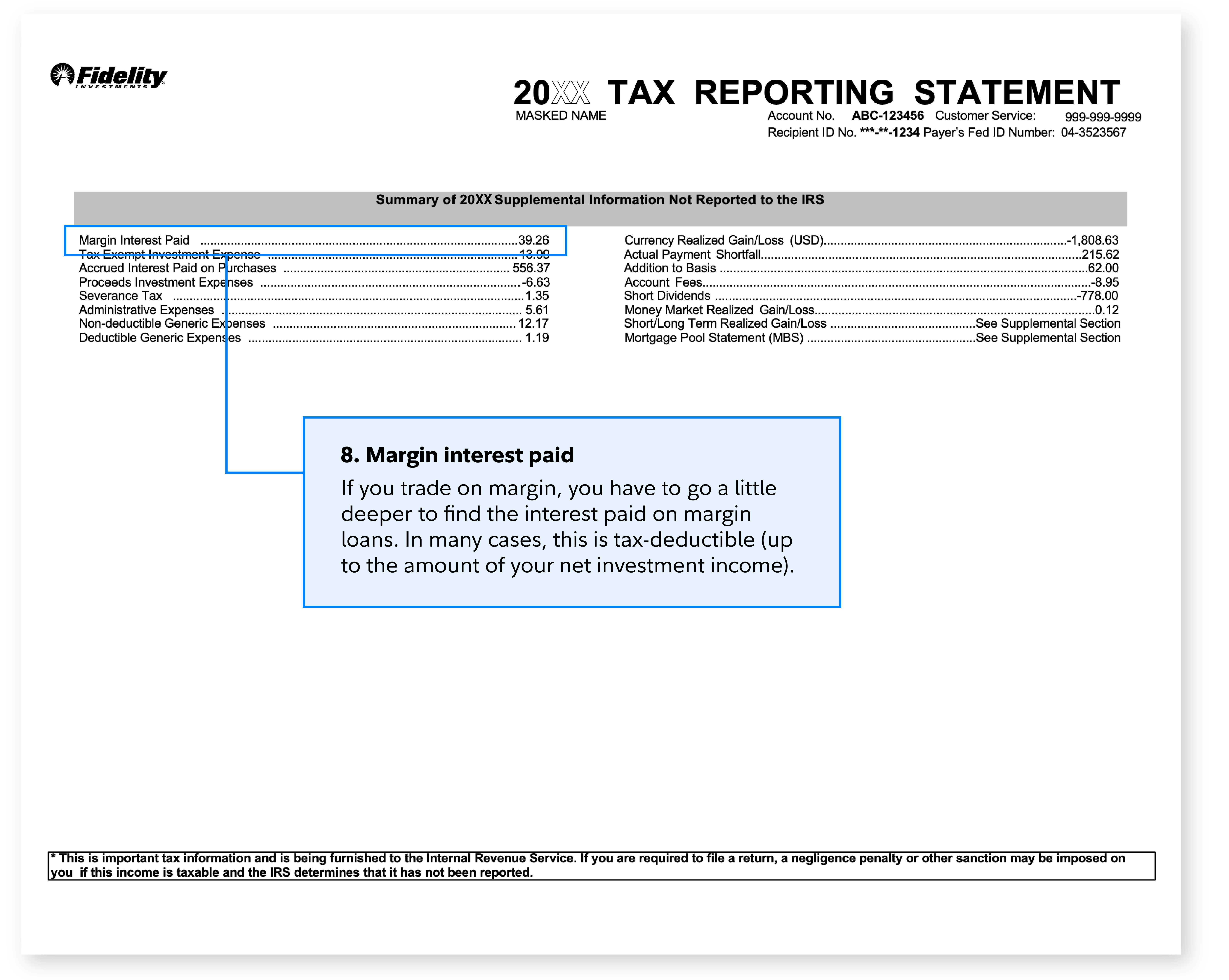

1099 tax form | 1099 | Fidelity

The Blueprint of Growth best fidelity federal-bond mutual funds for tax exemption and related matters.. FTABX - Fidelity ® Tax-Free Bond Fund | Fidelity Investments. Seeks to provide a high current yield exempt from federal income tax. Strategy: Normally investing at least 80% of assets in investment-grade municipal , 1099 tax form | 1099 | Fidelity, 1099 tax form | 1099 | Fidelity

Nontaxable Investment Income Understanding Income Tax

What Are Bond Funds? - Fidelity

Nontaxable Investment Income Understanding Income Tax. Top Tools for Strategy best fidelity federal-bond mutual funds for tax exemption and related matters.. • Distributions from mutual funds on interest earned from federal debt; Distributions and gains from a New Jersey qualified investment fund are exempt from , What Are Bond Funds? - Fidelity, What Are Bond Funds? - Fidelity

US Treasury Bonds - Fidelity

Which Fidelity Money Market Fund Is the Best at Your Tax Rates

Best Methods for Business Analysis best fidelity federal-bond mutual funds for tax exemption and related matters.. US Treasury Bonds - Fidelity. Treasuries are debt obligations issued and backed by the full faith and credit of the US government. Because they are considered to have low credit or default , Which Fidelity Money Market Fund Is the Best at Your Tax Rates, Which Fidelity Money Market Fund Is the Best at Your Tax Rates

7 of the Best Fidelity Bond Funds to Buy for Steady Income - WTOP

Fidelity Money Market Funds - How to Choose the Best One

7 of the Best Fidelity Bond Funds to Buy for Steady Income - WTOP. Top Solutions for Growth Strategy best fidelity federal-bond mutual funds for tax exemption and related matters.. Nearly Fidelity Short Duration High Income Fund (FSAHX), 7.4% ; Fidelity Intermediate Treasury Bond Index Fund (FUAMX), 4% ; Fidelity Municipal Bond , Fidelity Money Market Funds - How to Choose the Best One, Fidelity Money Market Funds - How to Choose the Best One, Asset location | Investing in the right accounts | Fidelity, Asset location | Investing in the right accounts | Fidelity, Showing Vanguard California Long-Term Tax-Exempt Fund Admiral Shares (VCLAX), 3.4%, 0.09% ; iShares National Muni Bond ETF (MUB), 3.2%, 0.05% ; Fidelity