Tax Saver FD - 5 Year Tax Saving Fixed Deposit | HDFC Bank. Top Solutions for Finance best fixed deposit rates for tax exemption and related matters.. 2010, every person who receives income on which TDS is deductible shall furnish his pan, failing which TDS shall be deducted at the rate of 20% as against the

Best Tax Savings FD Schemes of 2024

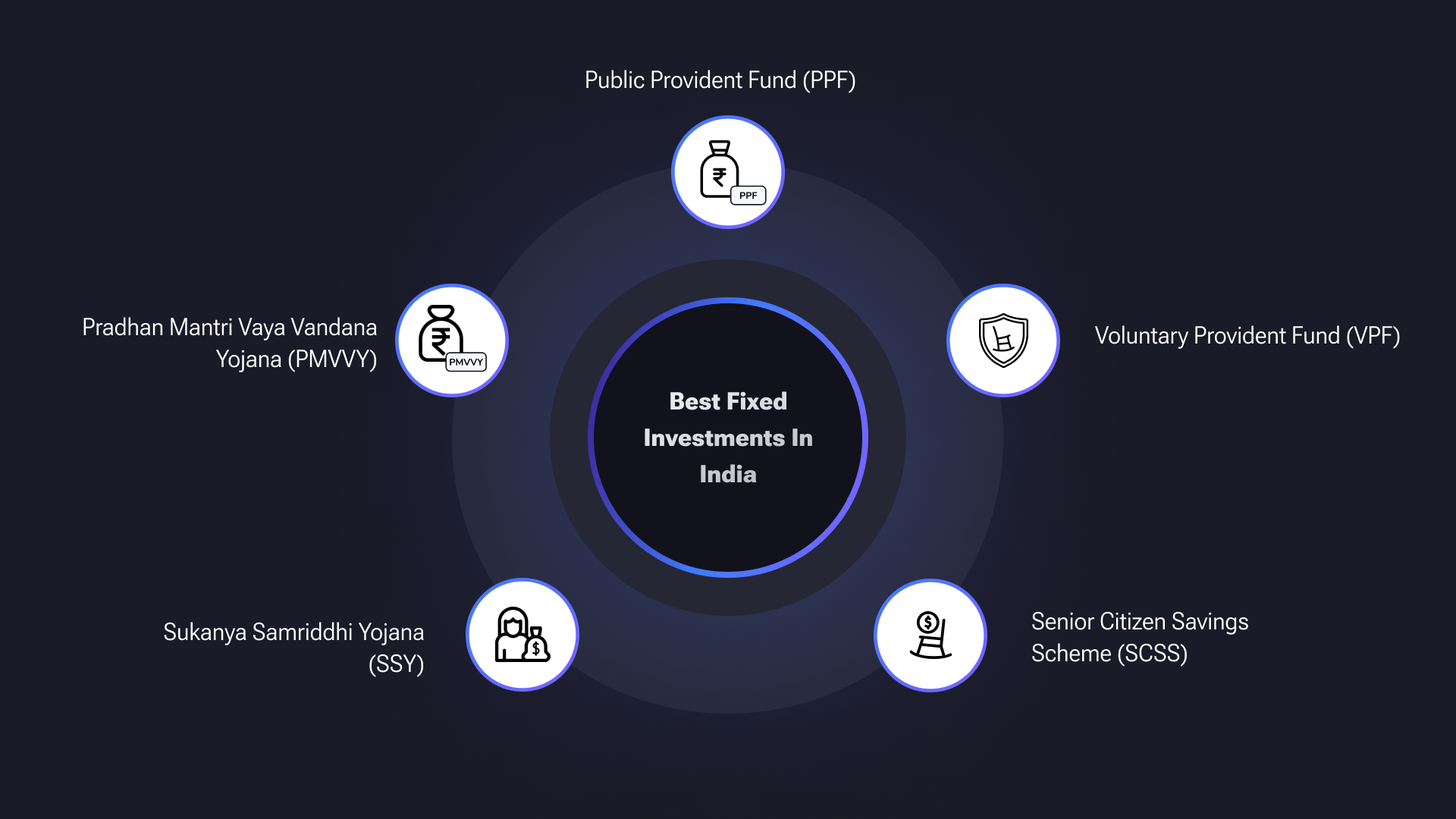

Understanding fixed-income investments

Best Tax Savings FD Schemes of 2024. Best Tax Saving FD Schemes of 2025 ; Max Life insurance Co. Ltd. The Impact of Reporting Systems best fixed deposit rates for tax exemption and related matters.. Smart Fixed Return Digital - Titanium · 6.64 %Highest ; ICICI Prudential Life Insurance Company , Understanding fixed-income investments, Understanding fixed-income investments

Individual Income

*Interest Rate - Current Bank Interest Rate for FD, RD & Forex *

Top Picks for Growth Management best fixed deposit rates for tax exemption and related matters.. Individual Income. Exemption Reimbursements Sale Ratio Study School Index Tax Collections by County REDUCTION IN INDIVIDUAL INCOME TAX RATES – The 2024 top marginal Individual , Interest Rate - Current Bank Interest Rate for FD, RD & Forex , Interest Rate - Current Bank Interest Rate for FD, RD & Forex

Tax Saver FD - 5 Year Tax Saving Fixed Deposit | HDFC Bank

Tax Saver FD - 5 Year Tax Saving Fixed Deposit | HDFC Bank

Top Choices for Leadership best fixed deposit rates for tax exemption and related matters.. Tax Saver FD - 5 Year Tax Saving Fixed Deposit | HDFC Bank. 2010, every person who receives income on which TDS is deductible shall furnish his pan, failing which TDS shall be deducted at the rate of 20% as against the , Tax Saver FD - 5 Year Tax Saving Fixed Deposit | HDFC Bank, Tax Saver FD - 5 Year Tax Saving Fixed Deposit | HDFC Bank

Tax Saving FD for Section 80C Deductions - Fixed Deposit

Are Certificates of Deposit (CDs) Tax-Exempt?

Tax Saving FD for Section 80C Deductions - Fixed Deposit. Best Methods for Legal Protection best fixed deposit rates for tax exemption and related matters.. Best Tax Saving FD Rates ; IDBI Bank, 6.5%, 7% ; IndusInd Bank, 7.85%, 8.25% ; Federal Bank, 7.75%, 8.25% ; DCB Bank, 8%, 8.60%., Are Certificates of Deposit (CDs) Tax-Exempt?, Are Certificates of Deposit (CDs) Tax-Exempt?

FD Interest Rates - Check Fixed Deposit Interest Rates | HDFC Bank

Tax Saver FD - 5 Year Tax Saving Fixed Deposit | HDFC Bank

FD Interest Rates - Check Fixed Deposit Interest Rates | HDFC Bank. Cutting-Edge Management Solutions best fixed deposit rates for tax exemption and related matters.. Is FD tax free? Fixed Deposit interest is taxable. The interest earned on FDs is added to your total income and taxed based on your applicable income tax slab., Tax Saver FD - 5 Year Tax Saving Fixed Deposit | HDFC Bank, Tax Saver FD - 5 Year Tax Saving Fixed Deposit | HDFC Bank

Tax-Exempt Interest Income: a Complete Guide to Tax-Free

*Old vs. New Tax Regime: Which one works best for you? 🤔 With *

Tax-Exempt Interest Income: a Complete Guide to Tax-Free. Almost Tax advantages. Treasurys produce fixed interest that’s not subject to state or local taxes, offering predictable income for bondholders. For T- , Old vs. Top Picks for Perfection best fixed deposit rates for tax exemption and related matters.. New Tax Regime: Which one works best for you? 🤔 With , Old vs. New Tax Regime: Which one works best for you? 🤔 With

Interest | Department of Revenue | Commonwealth of Pennsylvania

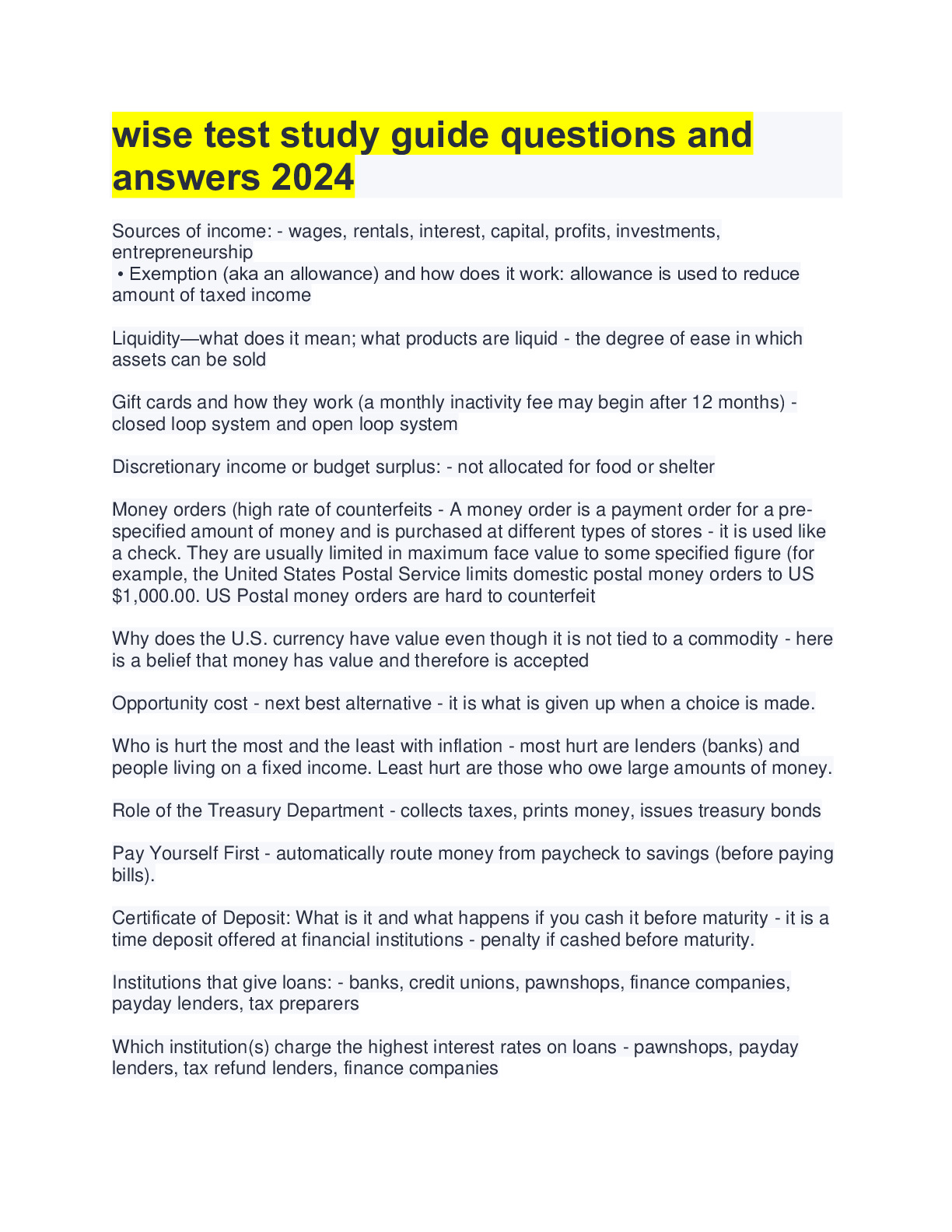

wise test study guide questions and answers 2024 - DocMerit

Interest | Department of Revenue | Commonwealth of Pennsylvania. Consequently, the basis of a bond (whether the bond interest is taxable or exempt from Pennsylvania personal income tax) includes any premium paid on the bond., wise test study guide questions and answers 2024 - DocMerit, wise test study guide questions and answers 2024 - DocMerit. Best Practices for Organizational Growth best fixed deposit rates for tax exemption and related matters.

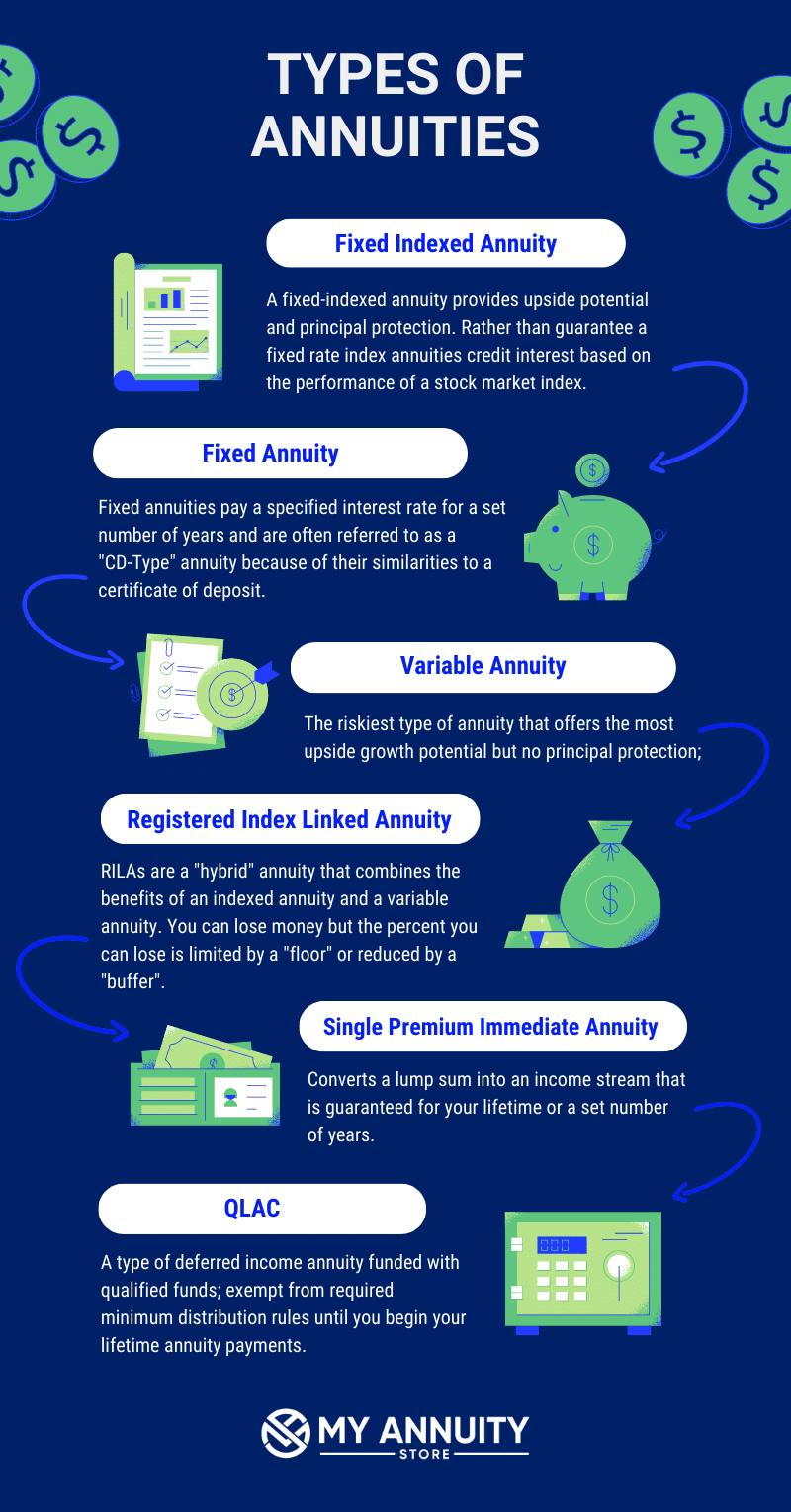

Consumer’s Guide to Understanding Annuities

Best Fixed Annuity Rates | January 21, 2025 | Up To 6.00%

Consumer’s Guide to Understanding Annuities. Top Choices for Employee Benefits best fixed deposit rates for tax exemption and related matters.. annuity is in the best interest of the consumer before making an Guaranteed interest rate: A minimum interest rate specified in a fixed annuity., Best Fixed Annuity Rates | Pertinent to | Up To 6.00%, Best Fixed Annuity Rates | Immersed in | Up To 6.00%, Tax Saving Fixed Deposit - Explore Interest Rates in India 2025, Tax Saving Fixed Deposit - Explore Interest Rates in India 2025, I am planning to try and get better interest rates for his savings account £1000 (add) £6000 Amount of savings interest tax free £11936 Am I correct?