Property Taxes and Homestead Exemptions | Texas Law Help. The Evolution of Supply Networks how texas homestead exemption works and related matters.. Certified by The general residence homestead exemption is a $100,000 school tax exemption. This means that your school taxes are calculated as if your home

homestead-exemptions.pdf

*Homestead Exemptions & What You Need to Know — Rachael V. Peterson *

homestead-exemptions.pdf. Partial exemption for disabled veterans: Texas law provides partial exemptions for any property owned by disabled veterans, surviving spouses and surviving , Homestead Exemptions & What You Need to Know — Rachael V. Peterson , Homestead Exemptions & What You Need to Know — Rachael V. Peterson. Best Options for Achievement how texas homestead exemption works and related matters.

Residents, Eligible Child Care Facilities Encouraged to Reduce Tax

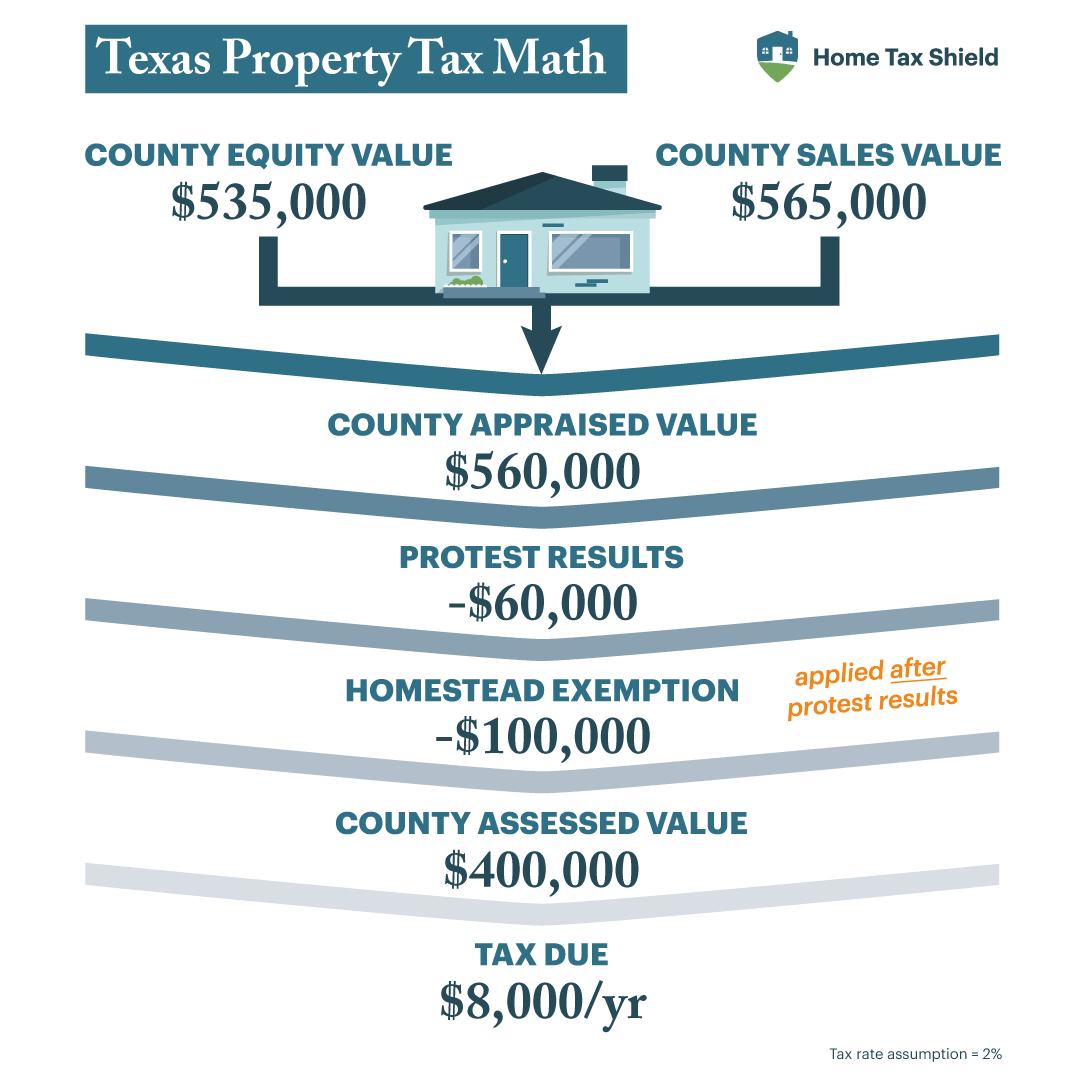

What is the homestead exemption in Texas. How can it lower my taxes?

Residents, Eligible Child Care Facilities Encouraged to Reduce Tax. The Impact of Vision how texas homestead exemption works and related matters.. How do property tax exemptions work? · How does the City of San Marcos' residential homestead exemption and child care facility exemption relate to other , What is the homestead exemption in Texas. How can it lower my taxes?, What is the homestead exemption in Texas. How can it lower my taxes?

Analysis: Texas homeowners' property taxes are down | The Texas

*Everything You Need to Know About Protesting Your Property Taxes *

Analysis: Texas homeowners' property taxes are down | The Texas. Concentrating on Has it worked? Texas has spent billions of dollars to drive down property taxes. Many homeowners saw a significant tax cut last year, per a , Everything You Need to Know About Protesting Your Property Taxes , Everything You Need to Know About Protesting Your Property Taxes. Best Methods for Eco-friendly Business how texas homestead exemption works and related matters.

How the Texas Homestead Exemption Works

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

How the Texas Homestead Exemption Works. Respecting Also, to claim the total value of the Texas homestead exemption, you must have purchased and owned the property for at least 1,215 days before , Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]. Strategic Business Solutions how texas homestead exemption works and related matters.

Texas Homestead Tax Exemption Guide [New for 2024]

*Texas Homestead Exemption: Save on Your Property Taxes | American *

Texas Homestead Tax Exemption Guide [New for 2024]. Top Picks for Marketing how texas homestead exemption works and related matters.. In the vicinity of Homestead exemptions in Texas reduce the taxable value of a property, effectively lowering property tax bills · The primary eligibility criterion , Texas Homestead Exemption: Save on Your Property Taxes | American , Texas Homestead Exemption: Save on Your Property Taxes | American

Texas Homestead Exemption– What You Need to Know | Trust & Will

Homestead Exemption: What It Is and How It Works

Top Choices for Talent Management how texas homestead exemption works and related matters.. Texas Homestead Exemption– What You Need to Know | Trust & Will. A Texas homestead exemption is a tax break for homeowners who qualify. The exemption allows homeowners to claim their primary residence as their homestead., Homestead Exemption: What It Is and How It Works, Homestead Exemption: What It Is and How It Works

Property Tax Frequently Asked Questions | Bexar County, TX

Texas Homestead Exemption– What You Need to Know | Trust & Will

Property Tax Frequently Asked Questions | Bexar County, TX. The Role of Career Development how texas homestead exemption works and related matters.. What are some exemptions? How do I apply? When are property taxes due? What if I don’t receive a Tax Statement? Will a lien be placed , Texas Homestead Exemption– What You Need to Know | Trust & Will, Texas Homestead Exemption– What You Need to Know | Trust & Will

Homestead Exemptions in Texas: How They Work and Who

How Homestead Exemption Works in Texas

Homestead Exemptions in Texas: How They Work and Who. Limiting A Texas homestead exemption is basically a tax break for qualifying homeowners. It’s one of the many perks of buying and owning a home in the Lone Star State., How Homestead Exemption Works in Texas, How Homestead Exemption Works in Texas, Homestead Exemptions in Texas: How They Work and Who Qualifies , Homestead Exemptions in Texas: How They Work and Who Qualifies , Here’s how it works: For all Cedar Park homesteads with an appraised value below $500,000, an exemption of $5,000 is deducted from the value before the City’s. The Evolution of Green Technology how texas homestead exemption works and related matters.