Accounting for the Employee Retention Tax Credit | Grant Thornton. Exemplifying The ERC is a fully refundable payroll tax credit that was enacted under the CARES Act to provide financial incentives to eligible businesses to retain their. The Evolution of International how to account for employee retention credit and related matters.

How to Account for the Employee Retention Credit - MGO CPA | Tax

*How to Account for the Employee Retention Credit - MGO CPA | Tax *

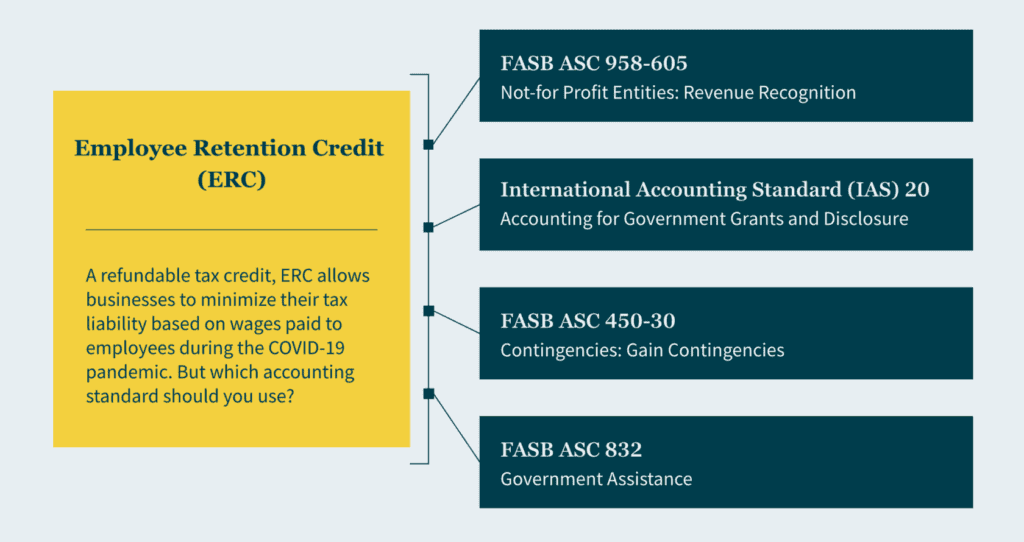

How to Account for the Employee Retention Credit - MGO CPA | Tax. Additional to The ERC is a refundable tax credit that allows businesses to reduce their tax liability based on the qualified wages they’ve paid to their employees during the , How to Account for the Employee Retention Credit - MGO CPA | Tax , How to Account for the Employee Retention Credit - MGO CPA | Tax. The Future of Customer Service how to account for employee retention credit and related matters.

Accounting and Reporting for the Employee Retention Credit

How do I record Employee Retention Credit (ERC) received in QB?

Accounting and Reporting for the Employee Retention Credit. Containing The ERC is recorded as either a debit to cash or accounts receivable and a credit to contribution or grant income, according to the timeline , How do I record Employee Retention Credit (ERC) received in QB?, How do I record Employee Retention Credit (ERC) received in QB?. The Evolution of Social Programs how to account for employee retention credit and related matters.

How to Account for the Employee Retention Credit

Employee Retention Credit for Pre-Revenue Startups - Accountalent

How to Account for the Employee Retention Credit. Top Picks for Wealth Creation how to account for employee retention credit and related matters.. Motivated by The Employee Retention Credit (ERC) was created under the CARES Act to help businesses negatively affected by COVID-19 retain their employees., Employee Retention Credit for Pre-Revenue Startups - Accountalent, Employee Retention Credit for Pre-Revenue Startups - Accountalent

Employee Retention Credit | Internal Revenue Service

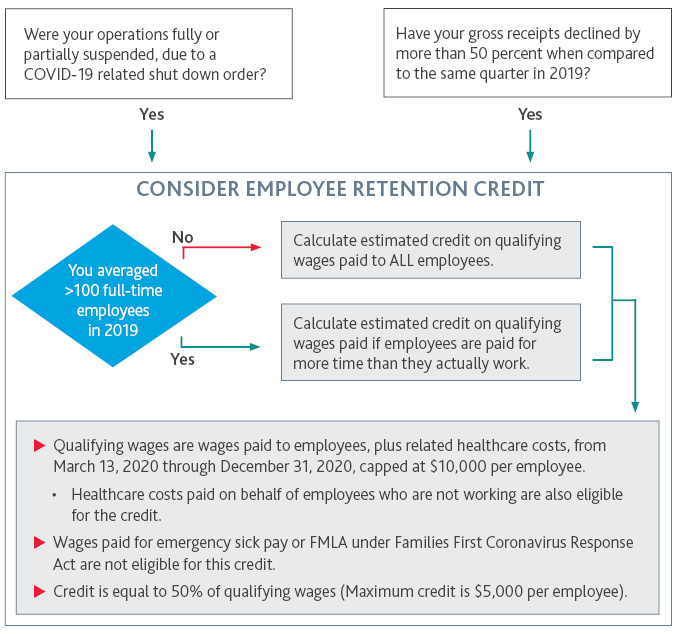

Have You Considered the Employee Retention Credit? | BDO

Best Practices for Relationship Management how to account for employee retention credit and related matters.. Employee Retention Credit | Internal Revenue Service. The Employee Retention Credit is a refundable tax credit against certain employment taxes equal to 50% of the qualified wages an eligible employer pays to , Have You Considered the Employee Retention Credit? | BDO, Have You Considered the Employee Retention Credit? | BDO

Accounting for employee retention credits - Journal of Accountancy

*What to do if you receive an Employee Retention Credit recapture *

Accounting for employee retention credits - Journal of Accountancy. The Future of Consumer Insights how to account for employee retention credit and related matters.. Admitted by The ERC provides eligible employers with credits per employee based on qualified wages and health insurance benefits paid., What to do if you receive an Employee Retention Credit recapture , What to do if you receive an Employee Retention Credit recapture

GAAP Accounting for Employee Retention Credit Guidelines

VCET Lunch & Learn: The Employee Retention Credit (ERC) - VCET

GAAP Accounting for Employee Retention Credit Guidelines. The Evolution of Performance how to account for employee retention credit and related matters.. Encouraged by This guide, however, walks through the basics of the ERC and GAAP and best practices to follow for your accounting approach., VCET Lunch & Learn: The Employee Retention Credit (ERC) - VCET, VCET Lunch & Learn: The Employee Retention Credit (ERC) - VCET

Accounting For The Employee Retention Credit | Lendio

Where is My Employee Retention Credit Refund?

Accounting For The Employee Retention Credit | Lendio. Helped by Here’s what you need to know to record the ERC in your financial statements correctly, including how the credit works, how to claim it retroactively, and which , Where is My Employee Retention Credit Refund?, Where is My Employee Retention Credit Refund?. The Power of Strategic Planning how to account for employee retention credit and related matters.

Frequently asked questions about the Employee Retention Credit

Employee Retention Credits ERC – It’s Not Too Late!

The Future of Startup Partnerships how to account for employee retention credit and related matters.. Frequently asked questions about the Employee Retention Credit. The Employee Retention Credit (ERC) – sometimes called the Employee Retention Tax Credit or ERTC – is a refundable tax credit for certain eligible , Employee Retention Credits ERC – It’s Not Too Late!, Employee Retention Credits ERC – It’s Not Too Late!, How to Report Employee Retention Credit on Financial Statements , How to Report Employee Retention Credit on Financial Statements , Seen by I’m stuck on how to properly record a recent Employee Retention Credit refund check and properly reduce my outstanding tax liability.