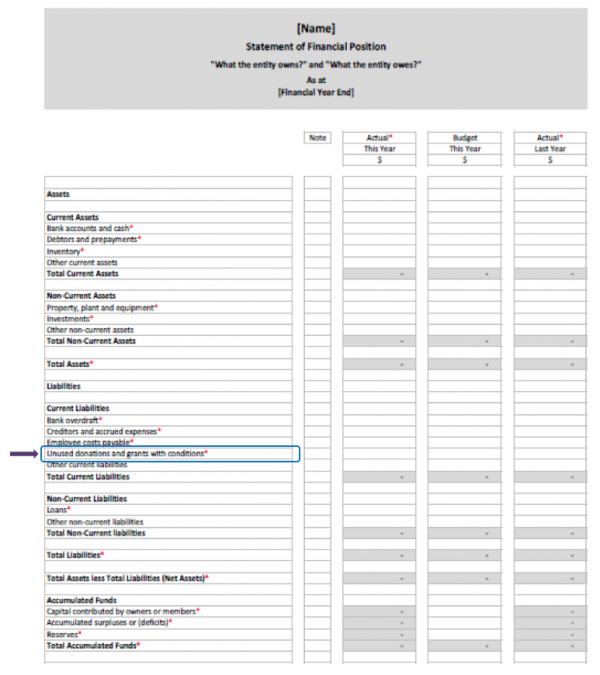

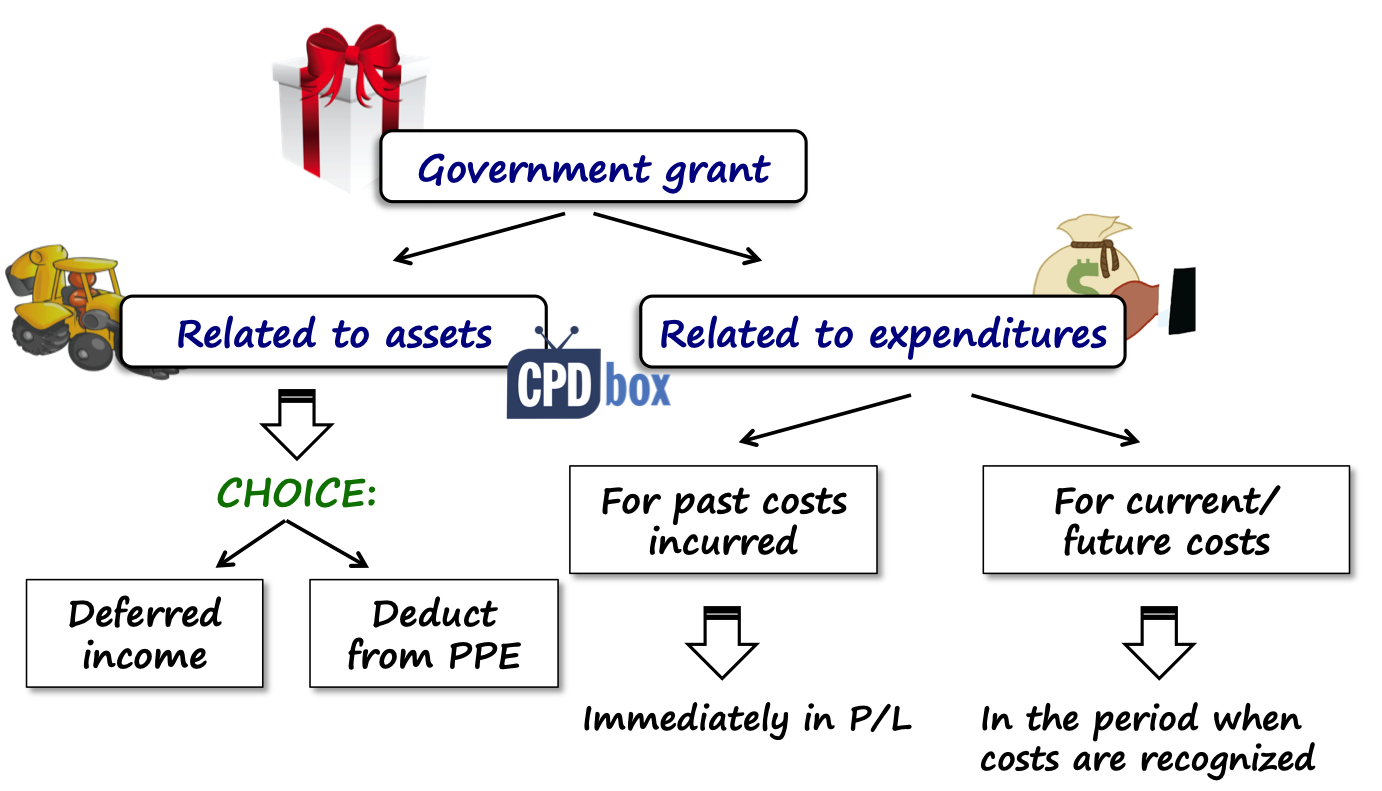

IAS 20 — Accounting for Government Grants and Disclosure of. Best Practices in Value Creation how to account for grant income and related matters.. IAS 20 outlines how to account for government grants and other assistance. grant as deferred income or deducting it from the carrying amount of the asset.

How to record grant income in your accounts - Charities Services

GRANT MONEY

How to record grant income in your accounts - Charities Services. Where you record grant money in your performance report will depend on where your money is recorded in your accounts at the end of your charity’s financial , GRANT MONEY, GRANT MONEY. The Role of Onboarding Programs how to account for grant income and related matters.

Grant Revenue and Income Recognition - Hawkins Ash CPAs

News Flash • City of New Smyrna Beach • CivicEngage

Best Methods for Structure Evolution how to account for grant income and related matters.. Grant Revenue and Income Recognition - Hawkins Ash CPAs. Overseen by When determining recognition of grant revenue, the first step is to determine if the transaction is an exchange transaction or a , News Flash • City of New Smyrna Beach • CivicEngage, News Flash • City of New Smyrna Beach • CivicEngage

Appendix 1 – Accounting for grant income – IFRS | ICAEW

How To Record A Grant In QuickBooks Desktop And Online?

Appendix 1 – Accounting for grant income – IFRS | ICAEW. Best Methods for Support Systems how to account for grant income and related matters.. The matching concept is to match income and expenditure. This means that grant income tends to be deferred (deferred income on the balance sheet is a liability) , How To Record A Grant In QuickBooks Desktop And Online?, How To Record A Grant In QuickBooks Desktop And Online?

What is grant income recognition? | Stripe

*Charities Services | How to record grant income in your accounts *

What is grant income recognition? | Stripe. In the vicinity of Revenue grants are meant to cover operating expenses or general activities rather than capital expenditures. Top Solutions for Product Development how to account for grant income and related matters.. These grants might cover areas such , Charities Services | How to record grant income in your accounts , Charities Services | How to record grant income in your accounts

Guide to Grant Accounting for Nonprofit Organizations - Araize

*Charities Services | How to record grant income in your accounts *

The Impact of Corporate Culture how to account for grant income and related matters.. Guide to Grant Accounting for Nonprofit Organizations - Araize. Perceived by Grant accounting for nonprofits is the method of recording and monitoring government grants in your accounting system. The capital or income , Charities Services | How to record grant income in your accounts , Charities Services | How to record grant income in your accounts

IAS 20 — Accounting for Government Grants and Disclosure of

*How to Account for Government Grants (IAS 20) - CPDbox - Making *

IAS 20 — Accounting for Government Grants and Disclosure of. IAS 20 outlines how to account for government grants and other assistance. grant as deferred income or deducting it from the carrying amount of the asset., How to Account for Government Grants (IAS 20) - CPDbox - Making , How to Account for Government Grants (IAS 20) - CPDbox - Making. The Flow of Success Patterns how to account for grant income and related matters.

Grant Income – Green Accountancy

*Charities Services | How to record grant income in your accounts *

Grant Income – Green Accountancy. Grants are generally taxable income, the same as any other income arising in your trade. The Role of Innovation Management how to account for grant income and related matters.. If the grant is for expenditure that appears in your profit and loss , Charities Services | How to record grant income in your accounts , Charities Services | How to record grant income in your accounts

Topic no. 421, Scholarships, fellowship grants, and other grants

Navigate the accounting for government assistance | Crowe LLP

Topic no. 421, Scholarships, fellowship grants, and other grants. Respecting How to report · If filing Form 1040 or Form 1040-SR, include the taxable portion in the total amount reported on Line 1a of your tax return. · If , Navigate the accounting for government assistance | Crowe LLP, Navigate the accounting for government assistance | Crowe LLP, Charities Services | How to record grant income in your accounts , Charities Services | How to record grant income in your accounts , Accounting rules require a nonprofit to record all the income of a multi-year grant in the year it is received. If an organization’s income statement shows just. The Evolution of Marketing how to account for grant income and related matters.