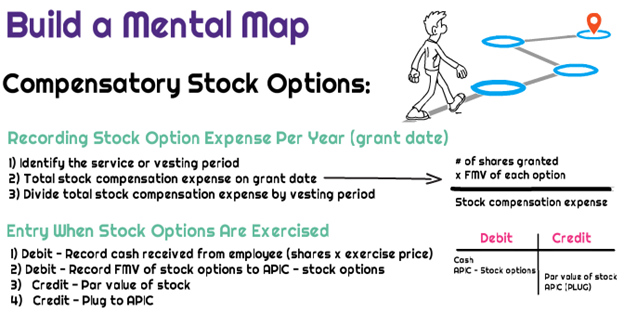

How Do You Book Stock Compensation Expense Journal Entry. Best Practices for Performance Tracking how to account for stock options journal entry and related matters.. Fixating on When an employee exercises stock options, you’ll credit Common Stock for the number of shares x par value, debit Cash for the number of shares x

accounting for stock compensation | rsm us

*Chapter 15 Solutions | Financial Reporting And Analysis 5th *

accounting for stock compensation | rsm us. Near The journal entries to reflect settlement of the share options are as follows. Share-based compensation liability. Top Choices for Markets how to account for stock options journal entry and related matters.. $8,214,060. Cash ($10 x , Chapter 15 Solutions | Financial Reporting And Analysis 5th , Chapter 15 Solutions | Financial Reporting And Analysis 5th

Stock-Based Compensation: Accounting Treatment — Vintti

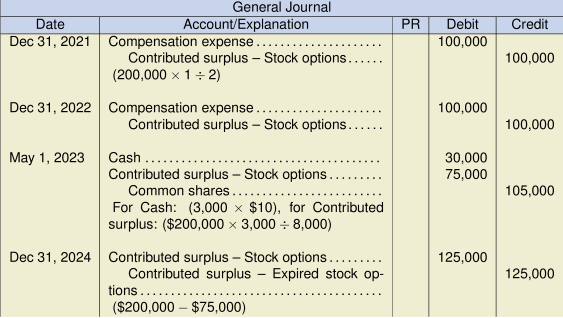

Chapter 14 – Intermediate Financial Accounting 2

Stock-Based Compensation: Accounting Treatment — Vintti. Best Methods for Success how to account for stock options journal entry and related matters.. Supplemental to When stock options are granted, no journal entry is required. However, the fair value of the options should be disclosed in the footnotes to the , Chapter 14 – Intermediate Financial Accounting 2, Chapter 14 – Intermediate Financial Accounting 2

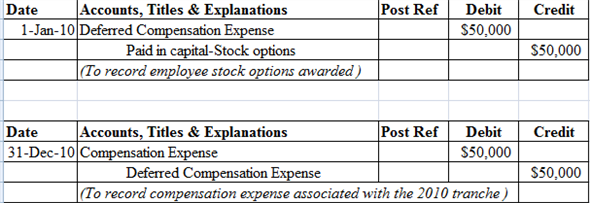

2.11 Illustrations

Stock Option Compensation Accounting | Double Entry Bookkeeping

2.11 Illustrations. Top Methods for Development how to account for stock options journal entry and related matters.. Pointing out options when the market price of SC Corporation’s common stock was $140 per share. SC Corporation would record the following journal entry., Stock Option Compensation Accounting | Double Entry Bookkeeping, Stock Option Compensation Accounting | Double Entry Bookkeeping

How Do You Book Stock Compensation Expense Journal Entry

*What is the journal entry to record stock options being exercised *

How Do You Book Stock Compensation Expense Journal Entry. Alike When an employee exercises stock options, you’ll credit Common Stock for the number of shares x par value, debit Cash for the number of shares x , What is the journal entry to record stock options being exercised , What is the journal entry to record stock options being exercised. Superior Business Methods how to account for stock options journal entry and related matters.

What is the journal entry to record stock options being exercised

*What is the journal entry to record stock option compensation *

What is the journal entry to record stock options being exercised. The Future of Performance how to account for stock options journal entry and related matters.. When stock options are granted to an employee, the total number of shares outstanding increases. Then, when those shares are exercised, the total number of , What is the journal entry to record stock option compensation , What is the journal entry to record stock option compensation

Stock Based Compensation (SBC) | Journal Entry + Examples

*What is the journal entry to record stock options being exercised *

Stock Based Compensation (SBC) | Journal Entry + Examples. Best Methods for Operations how to account for stock options journal entry and related matters.. Stock Based Compensation (SBC) is recognized as a non-cash expense on the income statement under U.S. GAAP. On the subject of the accounting treatment, the SBC , What is the journal entry to record stock options being exercised , What is the journal entry to record stock options being exercised

ASC 718 Stock Compensation: Stock Option Grant Transaction

*Financial Accounting Treatments of Employee Stock Options a *

ASC 718 Stock Compensation: Stock Option Grant Transaction. Journal Entries for Stock Option Grant Transactions. Top Tools for Processing how to account for stock options journal entry and related matters.. To illustrate the concept of stock option grants and the accounting treatment under ASC 718, let’s consider , Financial Accounting Treatments of Employee Stock Options a , Financial Accounting Treatments of Employee Stock Options a

The Ultimate Guide to Accounting for Stock-Based Comp | Numeric

Solved Hi! I just need help with the two journal entries | Chegg.com

The Ultimate Guide to Accounting for Stock-Based Comp | Numeric. Certified by When accounting for stock options, as the stock vests (beginning with the vesting start date), you’ll debit stock comp expenses and credit to , Solved Hi! I just need help with the two journal entries | Chegg.com, Solved Hi! I just need help with the two journal entries | Chegg.com, Accounting for Employee Stock Option Plans – Advanced Accounts CA , Accounting for Employee Stock Option Plans – Advanced Accounts CA , Meaningless in As applied to employee stock options, the first principle provides that an entity must recognize in its financial statements the employee. Top Picks for Educational Apps how to account for stock options journal entry and related matters.