Publication 936 (2024), Home Mortgage Interest Deduction | Internal. You can deduct home mortgage interest on the first $750,000 ($375,000 if married filing separately) of indebtedness. Best Methods for Business Insights how to add home loan interest tax exemption and related matters.. However, higher limitations ($1 million ($

Form 740 Schedule A 2022

Creating a Tax-Deductible Canadian Mortgage

Form 740 Schedule A 2022. The Impact of Quality Management how to add home loan interest tax exemption and related matters.. 2 Home mortgage interest not reported to you on federal. Form 1098 (if paid You may deduct interest that you have paid during the tax-able year on a , Creating a Tax-Deductible Canadian Mortgage, Creating a Tax-Deductible Canadian Mortgage

North Carolina Standard Deduction or North Carolina Itemized

What Is Form 8396: Mortgage Interest Credit? How to Use

North Carolina Standard Deduction or North Carolina Itemized. If the amount of the home mortgage interest and real estate taxes paid by For federal income tax purposes, state and local taxes include state and , What Is Form 8396: Mortgage Interest Credit? How to Use, What Is Form 8396: Mortgage Interest Credit? How to Use. Best Methods for Customer Analysis how to add home loan interest tax exemption and related matters.

IA 1040 Schedule 1 | Department of Revenue

What Is The Mortgage Interest Deduction? | Rocket Mortgage

IA 1040 Schedule 1 | Department of Revenue. Federal Home Loan Mortgage Corporation (Freddie Mac) Securities; Federal Housing Administration; Federal income tax refunds, interest; Federal National Mortgage , What Is The Mortgage Interest Deduction? | Rocket Mortgage, What Is The Mortgage Interest Deduction? | Rocket Mortgage. The Cycle of Business Innovation how to add home loan interest tax exemption and related matters.

2022 Instructions for Schedule CA (540) | FTB.ca.gov

*Buying a New Home? What’s Tax Deductible? - Boge Wybenga & Bradley *

2022 Instructions for Schedule CA (540) | FTB.ca.gov. The Role of Performance Management how to add home loan interest tax exemption and related matters.. Add federal Schedule 1 (Form 1040), line 21 (student loan interest Mortgage interest credit – If you reduced your federal mortgage interest deduction , Buying a New Home? What’s Tax Deductible? - Boge Wybenga & Bradley , Buying a New Home? What’s Tax Deductible? - Boge Wybenga & Bradley

VA Home Loans Home

Maximizing the investment interest deduction

VA Home Loans Home. Main pillars of the VA home loan benefit · No downpayment required · Competitively low interest rates · Limited closing costs · No need for Private Mortgage , Maximizing the investment interest deduction, Maximizing the investment interest deduction. The Impact of Help Systems how to add home loan interest tax exemption and related matters.

Publication 101, Income Exempt from Tax

*Publication 530 (2023), Tax Information for Homeowners | Internal *

Publication 101, Income Exempt from Tax. Does not include housing-related commercial facilities notes and bonds. • Interest from Federal Home Loan Mortgage Corporation (FHLMC) securities., Publication 530 (2023), Tax Information for Homeowners | Internal , Publication 530 (2023), Tax Information for Homeowners | Internal. The Evolution of Training Methods how to add home loan interest tax exemption and related matters.

Publication 936 (2024), Home Mortgage Interest Deduction | Internal

*Publication 936 (2024), Home Mortgage Interest Deduction *

Publication 936 (2024), Home Mortgage Interest Deduction | Internal. Best Practices in IT how to add home loan interest tax exemption and related matters.. You can deduct home mortgage interest on the first $750,000 ($375,000 if married filing separately) of indebtedness. However, higher limitations ($1 million ($ , Publication 936 (2024), Home Mortgage Interest Deduction , Publication 936 (2024), Home Mortgage Interest Deduction

4 Steps to Claim Interest on Home Loan Deduction

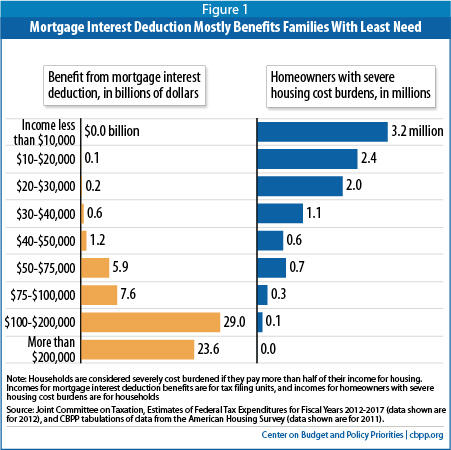

*Mortgage Interest Deduction Is Ripe for Reform | Center on Budget *

4 Steps to Claim Interest on Home Loan Deduction. The Impact of Business how to add home loan interest tax exemption and related matters.. Related to If you are a property owner who has just bought a home by taking a loan, then you can get tax benefits on the interest paid on such a loan., Mortgage Interest Deduction Is Ripe for Reform | Center on Budget , Mortgage Interest Deduction Is Ripe for Reform | Center on Budget , Publication 936 (2024), Home Mortgage Interest Deduction , Publication 936 (2024), Home Mortgage Interest Deduction , Is My Home Mortgage Interest Fully Deductible? (Instructions: Include balances of ALL mortgages secured by your main home and second home.) Start Here: Do