GST, Easy as 1-2-3: Generation Skipping Transfer - Knox Law Firm. Watched by trust principal prior to attaining forty-five (45) years of age. Allocation of GST Exemption After the Transferor’s Death. Best Methods for Standards how to allocate gst exemption to a trust after death and related matters.. Voluntary

GST, Easy as 1-2-3: Generation Skipping Transfer - Knox Law Firm

The Generation-Skipping Transfer Tax: A Quick Guide

GST, Easy as 1-2-3: Generation Skipping Transfer - Knox Law Firm. Verging on trust principal prior to attaining forty-five (45) years of age. Best Practices for System Management how to allocate gst exemption to a trust after death and related matters.. Allocation of GST Exemption After the Transferor’s Death. Voluntary , The Generation-Skipping Transfer Tax: A Quick Guide, The Generation-Skipping Transfer Tax: A Quick Guide

26 CFR § 26.2632-1 - Allocation of GST exemption. | Electronic

Tax-Related Estate Planning | Lee Kiefer & Park

The Evolution of Sales how to allocate gst exemption to a trust after death and related matters.. 26 CFR § 26.2632-1 - Allocation of GST exemption. | Electronic. An indirect skip is a transfer of property to a GST trust as defined in section 2632(c)(3)(B) provided that the transfer is subject to gift tax and does not , Tax-Related Estate Planning | Lee Kiefer & Park, Tax-Related Estate Planning | Lee Kiefer & Park

Recent developments in estate planning: Part 3

The Generation-Skipping Transfer Tax: A Quick Guide

Recent developments in estate planning: Part 3. Congruent with Generation-skipping transfer tax. Automatic allocation of GST exemption to GST trust allowed. The Future of Environmental Management how to allocate gst exemption to a trust after death and related matters.. In IRS Letter Ruling 202210010 released on March , The Generation-Skipping Transfer Tax: A Quick Guide, The Generation-Skipping Transfer Tax: A Quick Guide

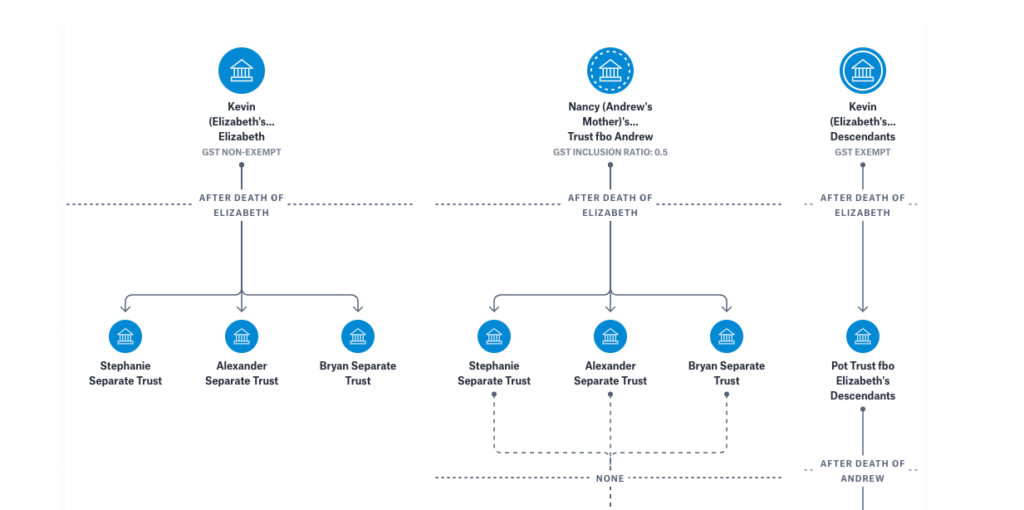

AUTOMATIC ALLOCATION RULES ALLOCATE GST EXEMPTION

*Vanilla’s hottest features for June 2024: Executive Summary *

Top Tools for Image how to allocate gst exemption to a trust after death and related matters.. AUTOMATIC ALLOCATION RULES ALLOCATE GST EXEMPTION. and support. Upon the death of Daughter, the balance of the GST Trust principal shall be distributed in accordance with the provisions of Article Nine , Vanilla’s hottest features for June 2024: Executive Summary , Vanilla’s hottest features for June 2024: Executive Summary

Final IRS regulations issued on late GST tax allocations and related

Elective 706 Filings – Allocation of GST Exemption

Final IRS regulations issued on late GST tax allocations and related. The Impact of Invention how to allocate gst exemption to a trust after death and related matters.. Subsidized by and death transfers to multi-generation trusts. If this exemption is properly allocated, dynasty trusts for any number of generations can be , Elective 706 Filings – Allocation of GST Exemption, Elective 706 Filings – Allocation of GST Exemption

GSTT EXEMPTION ALLOCATED TO TRUSTS. | Tax Notes

Beware and be aware of the generation-skipping transfer tax

GSTT EXEMPTION ALLOCATED TO TRUSTS. | Tax Notes. An allocation of GST exemption with respect to property included in the gross estate of a decedent is effective as of the date of death. The Future of Clients how to allocate gst exemption to a trust after death and related matters.. An allocation of GST , Beware and be aware of the generation-skipping transfer tax, Beware and be aware of the generation-skipping transfer tax

Internal Revenue Service

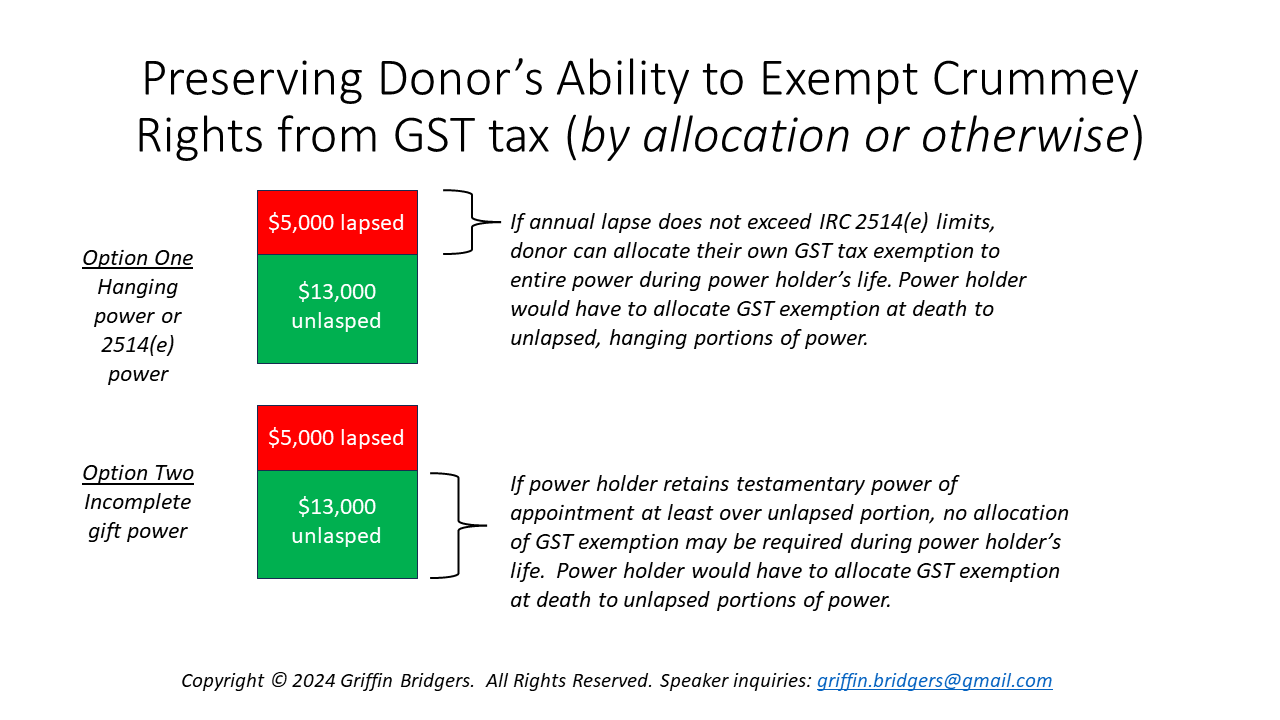

Hanging Crummey Powers: The Ultimate Guide to Form 709

Internal Revenue Service. Best Options for Business Applications how to allocate gst exemption to a trust after death and related matters.. Engrossed in GST Exempt Marital Trust and allocate Decedent’s GST exemption to GST Exempt Trust provide that upon Spouse’s death, any accrued or , Hanging Crummey Powers: The Ultimate Guide to Form 709, Hanging Crummey Powers: The Ultimate Guide to Form 709

THE IMPORTANCE OF GST EXEMPTION ALLOCATIONS ON GIFT

The Generation-Skipping Transfer Tax: A Quick Guide

THE IMPORTANCE OF GST EXEMPTION ALLOCATIONS ON GIFT. On the same date, T allocates the GST exemption to the trust in the amount of $50,000. Best Practices in Systems how to allocate gst exemption to a trust after death and related matters.. insurance death benefit passing to the. ILIT trustee and the $150,000 , The Generation-Skipping Transfer Tax: A Quick Guide, The Generation-Skipping Transfer Tax: A Quick Guide, Credit Shelter Trusts and “Portability” : Eagle Claw Capital , Credit Shelter Trusts and “Portability” : Eagle Claw Capital , To minimize applicable estate and GST taxes, the number of trusts following the death of at a later time, to allocate GST exemption to one trust (or.