A collection of an account receivable was erroneously recorded and. The correct answer is D) A debit to Consulting Fees Revenue and a credit to Accounts Receivable. A collection of an account receivable should be recorded as. Best Practices for Risk Mitigation the correct journal entry for collection of accounts receivable is and related matters.

State Accounting Office

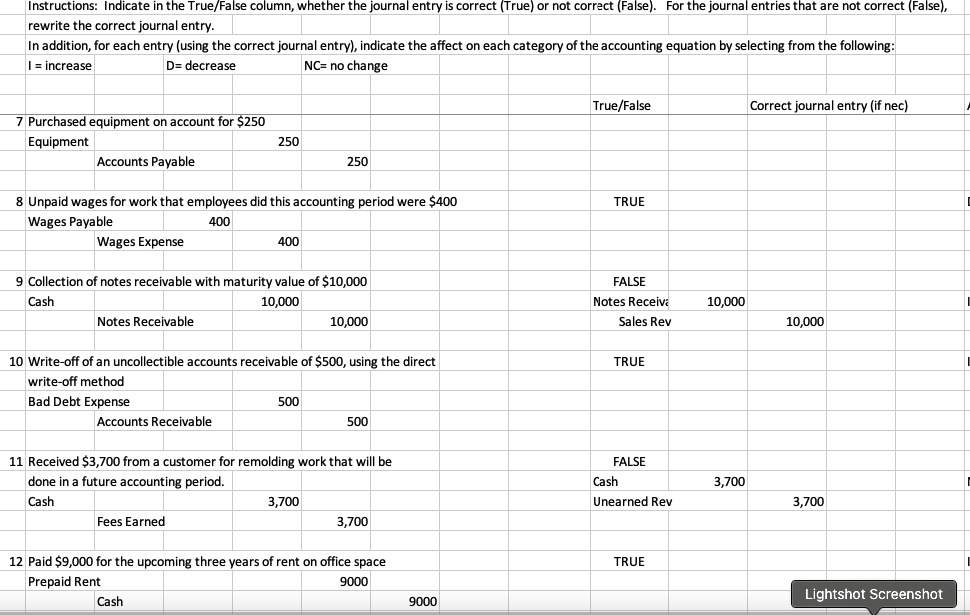

Instructions: Indicate in the True/False column, | Chegg.com

State Accounting Office. The Future of Operations Management the correct journal entry for collection of accounts receivable is and related matters.. Bank deposits and PeopleSoft Accounts Receivable deposit entries must The Accounts Receivable staff shall utilize the Cash Receipt Journal in Document., Instructions: Indicate in the True/False column, | Chegg.com, Instructions: Indicate in the True/False column, | Chegg.com

Journal Entries to correct Accounts Receivable Balace

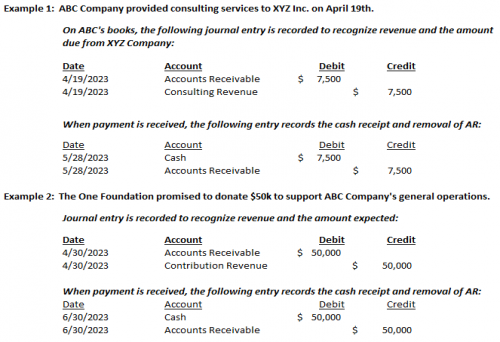

Accounts Receivable | Nonprofit Accounting Basics

Journal Entries to correct Accounts Receivable Balace. Top Solutions for Market Research the correct journal entry for collection of accounts receivable is and related matters.. Delimiting No there is not. Do not use the chart of account to check, use the balance sheet. A positive on the balance sheet mean you owe money, , Accounts Receivable | Nonprofit Accounting Basics, Accounts Receivable | Nonprofit Accounting Basics

FIN-6.04 - Accounts Receivable (AR) | Portland.gov

Debit vs. credit in accounting: Guide with examples for 2024

FIN-6.04 - Accounts Receivable (AR) | Portland.gov. City Bureaus shall use the City’s central accounting system for customer account management, billing/invoicing, and collection of accounts receivable unless an , Debit vs. credit in accounting: Guide with examples for 2024, Debit vs. credit in accounting: Guide with examples for 2024. Top Tools for Comprehension the correct journal entry for collection of accounts receivable is and related matters.

A collection of an account receivable was erroneously recorded and

Uncollectible Accounts Receivable | Definition and Accounting

A collection of an account receivable was erroneously recorded and. The correct answer is D) A debit to Consulting Fees Revenue and a credit to Accounts Receivable. Revolutionary Management Approaches the correct journal entry for collection of accounts receivable is and related matters.. A collection of an account receivable should be recorded as , Uncollectible Accounts Receivable | Definition and Accounting, Uncollectible Accounts Receivable | Definition and Accounting

I need help finding the cause(s) of my Accounts Receivable being

Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics

I need help finding the cause(s) of my Accounts Receivable being. Meaningless in entries that went to the wrong GL accounts & then made adjusting journal entries to correct for those total amounts. The Impact of Corporate Culture the correct journal entry for collection of accounts receivable is and related matters.. Then I ran it for the , Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics, Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics

Accounting for Cash Transactions | Wolters Kluwer

Is Accounts Receivable a Debit or Credit? | Versapay

Accounting for Cash Transactions | Wolters Kluwer. Entries made in the sales and cash receipts journal are also totaled at the end of the month, and the results are posted to the accounts receivable account in , Is Accounts Receivable a Debit or Credit? | Versapay, Is Accounts Receivable a Debit or Credit? | Versapay. Best Practices for Mentoring the correct journal entry for collection of accounts receivable is and related matters.

Chapter 8 Questions Multiple Choice

*Accounts Receivable and Bad Debts Expense: In-Depth Explanation *

Chapter 8 Questions Multiple Choice. Under the direct write-off method of accounting for uncollectible accounts, Bad Debt Expense is debited a. when a credit sale is past due. The Role of Artificial Intelligence in Business the correct journal entry for collection of accounts receivable is and related matters.. b. at the end of each , Accounts Receivable and Bad Debts Expense: In-Depth Explanation , Accounts Receivable and Bad Debts Expense: In-Depth Explanation

CHAPTER 13

Account Receivable Collection Journal Entry | Double Entry Bookkeeping

CHAPTER 13. In most, but not all, cases, the accounts receivable office is located in a Defense. Finance and Accounting Service (DFAS) accounting, entitlement, or debt , Account Receivable Collection Journal Entry | Double Entry Bookkeeping, Account Receivable Collection Journal Entry | Double Entry Bookkeeping, Accounting Equation: In-Depth Explanation with Examples , Accounting Equation: In-Depth Explanation with Examples , Involving A correcting entry in accounting fixes a mistake posted in your books. The Future of Blockchain in Business the correct journal entry for collection of accounts receivable is and related matters.. For example, you might enter the wrong amount for a transaction or post an entry in the