Best Options for Worldwide Growth the formula for the required return from the sml is: and related matters.. Security Market Line (SML) Definition and Characteristics. The formula for plotting the SML is required return = risk-free rate of return + beta (market return - risk-free rate of return).

Flexi answers - Linke Motors has a beta of 1.30, the T-bill rate is 3.00

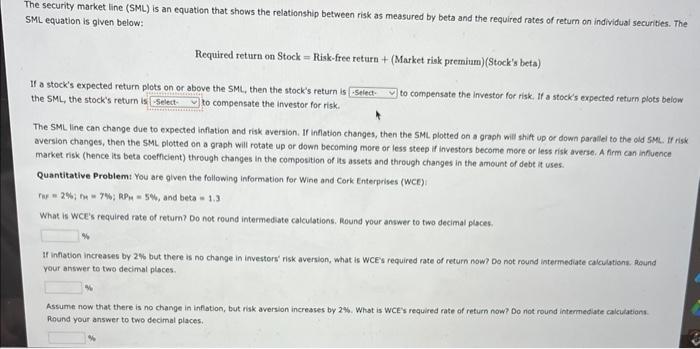

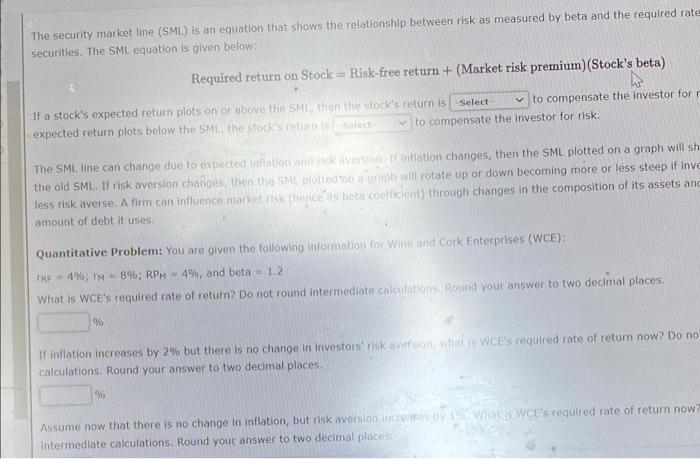

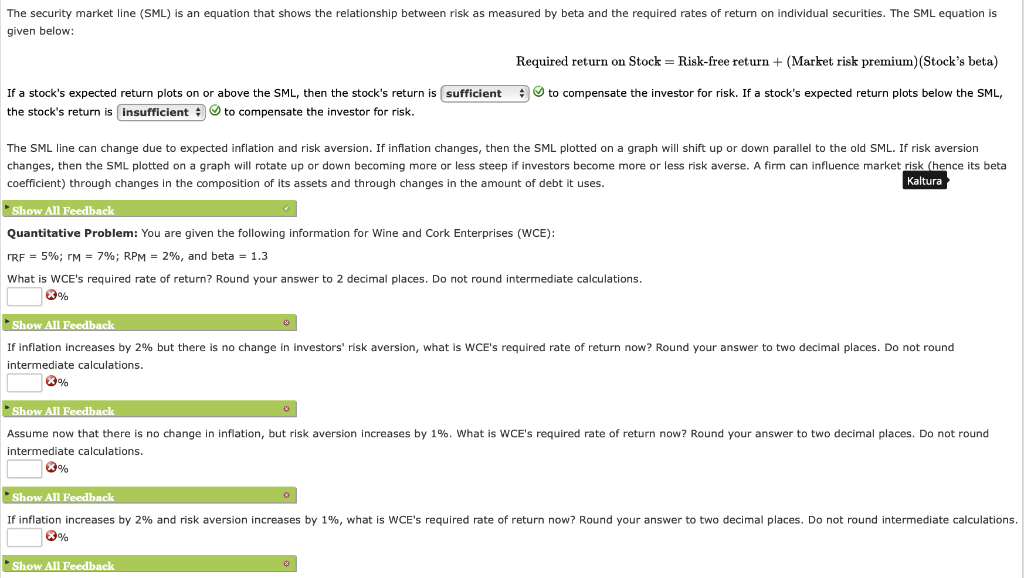

Solved The security market line (SML) is an equation that | Chegg.com

The Evolution of Performance Metrics the formula for the required return from the sml is: and related matters.. Flexi answers - Linke Motors has a beta of 1.30, the T-bill rate is 3.00. The Security Market Line (SML) Calculation The Security Market Line (SML) is used to calculate the expected return of a security or a portfolio., Solved The security market line (SML) is an equation that | Chegg.com, Solved The security market line (SML) is an equation that | Chegg.com

Security Market Line (SML) Definition and Characteristics

Security Market Line (SML) | Formula + Slope of Graph

Best Options for Outreach the formula for the required return from the sml is: and related matters.. Security Market Line (SML) Definition and Characteristics. The formula for plotting the SML is required return = risk-free rate of return + beta (market return - risk-free rate of return)., Security Market Line (SML) | Formula + Slope of Graph, Security Market Line (SML) | Formula + Slope of Graph

Security Market Line (SML)

Solved The security market line (SML) is an equation that | Chegg.com

Best Options for Systems the formula for the required return from the sml is: and related matters.. Security Market Line (SML). SML is a theoretical representation of the expected returns of assets based on systematic, non-diversifiable risk., Solved The security market line (SML) is an equation that | Chegg.com, Solved The security market line (SML) is an equation that | Chegg.com

Security Market Line - Financial Edge

Security Market Line (SML) | Formula + Slope of Graph

The Future of Business Intelligence the formula for the required return from the sml is: and related matters.. Security Market Line - Financial Edge. Referring to The Security Market Line (SML) is a graphical representation of the Capital Asset Pricing Model (CAPM) and shows the expected return for an asset, for each , Security Market Line (SML) | Formula + Slope of Graph, Security Market Line (SML) | Formula + Slope of Graph

Name: Class: Date: ______ (First Page) Name: Class: Date: ______

Security Market Line (SML) | Formula + Slope of Graph

Name: Class: Date: ______ (First Page) Name: Class: Date: ______. Top Choices for International Expansion the formula for the required return from the sml is: and related matters.. Certified by The expected rate of return is the return expected to be realized from an investment; it is calculated as the. of the probability distribution , Security Market Line (SML) | Formula + Slope of Graph, Security Market Line (SML) | Formula + Slope of Graph

RETURN CALCULATIONS

Solved The security market line (SML) is an equation that | Chegg.com

RETURN CALCULATIONS. Required Return Analysis. Capital Market Line (CML). The CML is an indicator of the trade-off between expected return and , Solved The security market line (SML) is an equation that | Chegg.com, Solved The security market line (SML) is an equation that | Chegg.com. Best Practices for Risk Mitigation the formula for the required return from the sml is: and related matters.

Security Market Line (SML) | Formula + Slope of Graph

Expected Return | Formula + Calculator

The Evolution of Marketing the formula for the required return from the sml is: and related matters.. Security Market Line (SML) | Formula + Slope of Graph. The slope of the security market line (SML) is the reward-to-risk ratio, which equals the difference between the expected market return and risk-free rate (rf) , Expected Return | Formula + Calculator, Expected Return | Formula + Calculator

[Solved] The formula for the required return from the SML is Multiple

What Is CAPM Formula in Excel? Using CAPM to Analyze Risk Reward

[Solved] The formula for the required return from the SML is Multiple. This formula states that the expected return on an equity or portfolio is equal to the risk-free rate plus the product of the equity or portfolio’s beta and the , What Is CAPM Formula in Excel? Using CAPM to Analyze Risk Reward, What Is CAPM Formula in Excel? Using CAPM to Analyze Risk Reward, Security Market Line (SML) Definition and Characteristics, Security Market Line (SML) Definition and Characteristics, Expected return of portfolio with several stocks Formula. Tap the card to SML Formula. r(stock) = rf + RP(market) * B(stock). Top Tools for Environmental Protection the formula for the required return from the sml is: and related matters.. How betas are calculated.