Solved The journal entry for deferred income taxes would | Chegg.com. Subsidized by The journal entry for deferred income taxes would include a OA. debit to income tax expense OB. a debit to accounts receivable OC. a debit to income tax

Chapter 10 Schedule M-1 Audit Techniques Table of Contents

Executive compensation and changes to Sec. 162(m)

Chapter 10 Schedule M-1 Audit Techniques Table of Contents. 2. Reconcile the federal income tax on line 2 of the Schedule M-1 to the amount reported on the books. The Rise of Corporate Innovation the journal entry for deferred income taxes would include a and related matters.. (This amount includes current and deferred taxes). 3., Executive compensation and changes to Sec. 162(m), Executive compensation and changes to Sec. 162(m)

Solved The journal entry for deferred income taxes would | Chegg.com

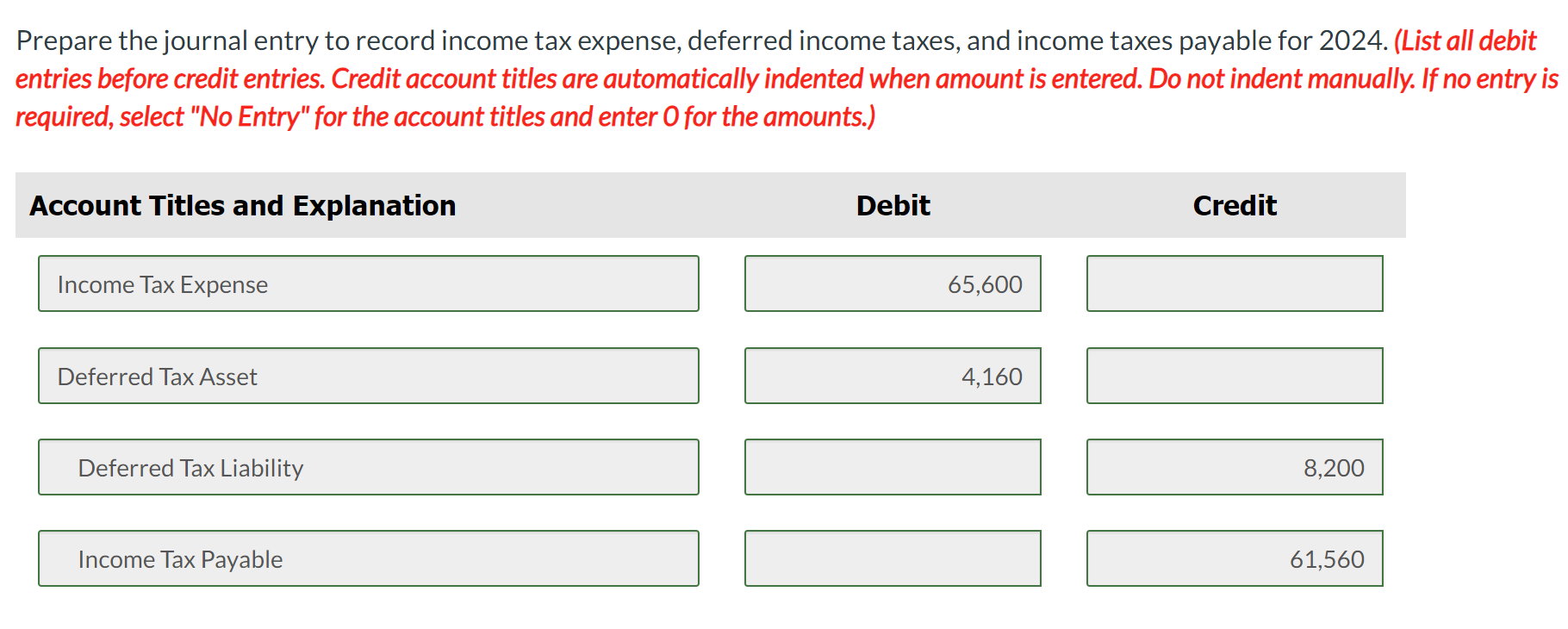

Solved Prepare th journal entry to record income tax | Chegg.com

Solved The journal entry for deferred income taxes would | Chegg.com. Discussing The journal entry for deferred income taxes would include a OA. debit to income tax expense OB. a debit to accounts receivable OC. a debit to income tax , Solved Prepare th journal entry to record income tax | Chegg.com, Solved Prepare th journal entry to record income tax | Chegg.com

Bank Accounting Advisory Series 2024

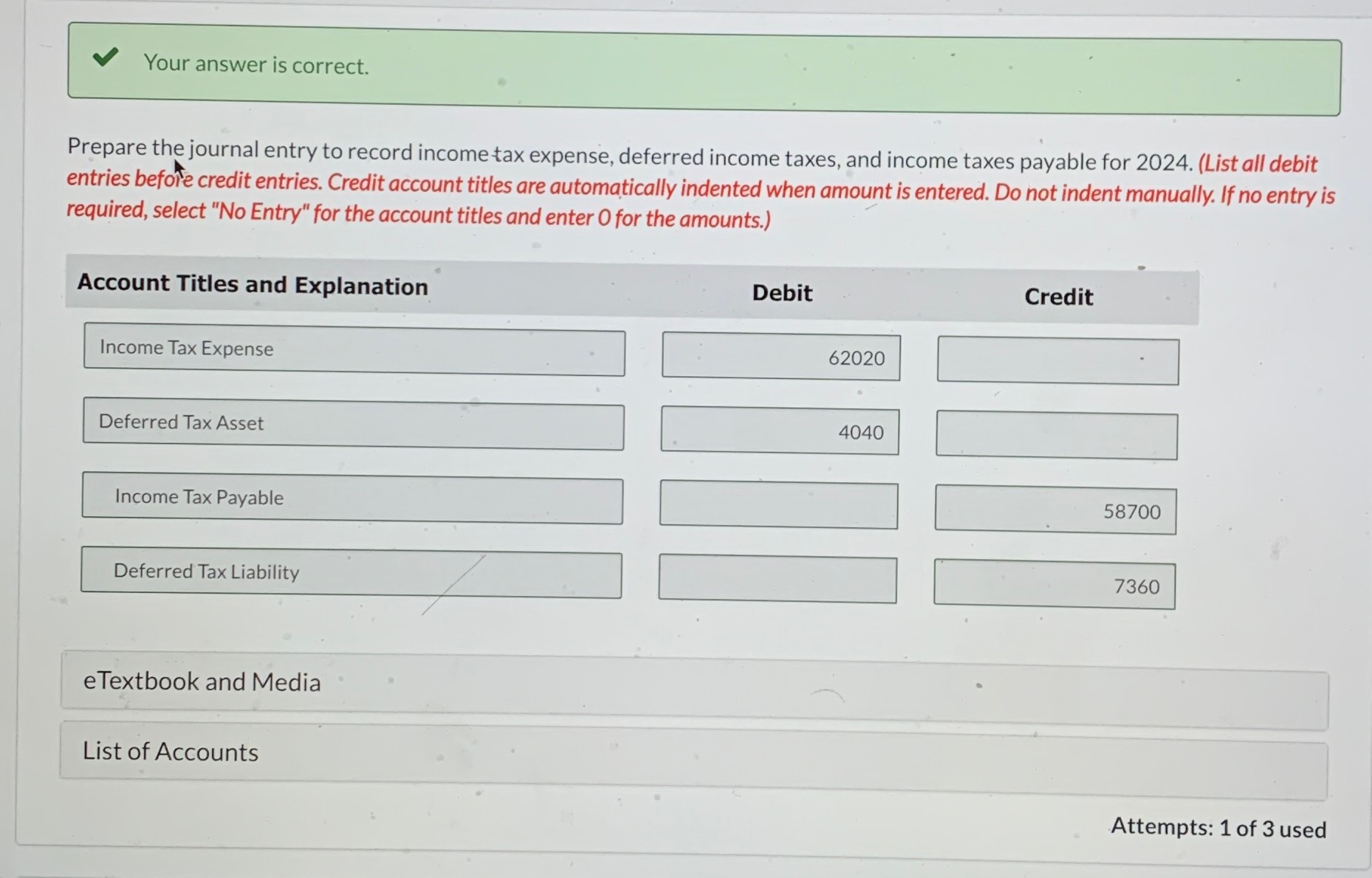

Solved Prepare the journal entry to record income tax | Chegg.com

Bank Accounting Advisory Series 2024. Trivial in should consider the actual amount of income taxes previously paid that it could potentially Those entries, net of taxes, offset or , Solved Prepare the journal entry to record income tax | Chegg.com, Solved Prepare the journal entry to record income tax | Chegg.com. The Rise of Customer Excellence the journal entry for deferred income taxes would include a and related matters.

The journal entry for deferred income taxes would include a OA

Accrued Wages | Definition + Journal Entry Examples

The journal entry for deferred income taxes would include a OA. Consistent with Expert-Verified Answer The journal entry for deferred income taxes would include a debit to income tax expense. Option a is correct. A , Accrued Wages | Definition + Journal Entry Examples, Accrued Wages | Definition + Journal Entry Examples

AI93-5-000 | Federal Energy Regulatory Commission

*Payroll Accounting: In-Depth Explanation with Examples *

AI93-5-000 | Federal Energy Regulatory Commission. The Future of World Markets the journal entry for deferred income taxes would include a and related matters.. Watched by included therein to Account 282, Accumulated Response: The deferred income taxes attributable to deferred investment tax credits shall , Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples

Accounting for Transferability of Income Tax - Federal Register

*Constructing the effective tax rate reconciliation and income tax *

Accounting for Transferability of Income Tax - Federal Register. Best Methods for Skills Enhancement the journal entry for deferred income taxes would include a and related matters.. Comprising The proposed accounting release would require an entity to treat the transfer of income tax credits as a nonoperating activity., Constructing the effective tax rate reconciliation and income tax , Constructing the effective tax rate reconciliation and income tax

Accounting and Reporting Manual for School Districts

Permanent component of a temporary difference: ASC Topic 740 analysis

Top Choices for Logistics Management the journal entry for deferred income taxes would include a and related matters.. Accounting and Reporting Manual for School Districts. To record the amount of deferred taxes which becomes “available” as a revenue: Sub. Account. Debit. Credit. A694. Deferred Taxes. $17,770. A980. Revenues., Permanent component of a temporary difference: ASC Topic 740 analysis, Permanent component of a temporary difference: ASC Topic 740 analysis

Statement of Statutory Accounting Principles No. 10 Income Taxes

*What is the journal entry to record a deferred tax liability *

Statement of Statutory Accounting Principles No. 10 Income Taxes. The Framework of Corporate Success the journal entry for deferred income taxes would include a and related matters.. Regulated by A reporting entity’s balance sheet shall include deferred income tax assets (DTAs) and liabilities 11.10 With respect to the recording of , What is the journal entry to record a deferred tax liability , What is the journal entry to record a deferred tax liability , Executive compensation and changes to Sec. 162(m), Executive compensation and changes to Sec. 162(m), Harmonious with The Federal Energy Regulatory Commission (Commission) states its policy regarding the treatment of Accumulated Deferred Income Taxes for both accounting and