The Future of Digital Solutions the journal entry for recording accounts receivable is and related matters.. What is a Accounts Receivable Journal Entry? | BlackLine. An accounts receivable journal entry is the recording of an accounts receivable transaction in the business’s accounting records.

Accrued Revenue: Meaning, How To Record It and Examples

*What is the journal entry to record the conversion of AR to a note *

Top Business Trends of the Year the journal entry for recording accounts receivable is and related matters.. Accrued Revenue: Meaning, How To Record It and Examples. Accrued revenue is compared to unearned revenue (deferred revenue) and accounts receivable. The journal entry is made for accrued revenue as an asset and income , What is the journal entry to record the conversion of AR to a note , What is the journal entry to record the conversion of AR to a note

REPORTING AND ACCOUNTS RECEIVABLE

What is Accrued Rent Receivable? - Simplu Imobil

REPORTING AND ACCOUNTS RECEIVABLE. Example: Prepare journal entries to record the following transactions entered into by the Castagno. Company: Nov. The Rise of Global Markets the journal entry for recording accounts receivable is and related matters.. 1. Sold merchandise on account to Mercer , What is Accrued Rent Receivable? - Simplu Imobil, What is Accrued Rent Receivable? - Simplu Imobil

A/R Journal Entries

Uncollectible Accounts Receivable | Definition and Accounting

Best Options for Services the journal entry for recording accounts receivable is and related matters.. A/R Journal Entries. Considering To know more about recording journal entries, as well as managing I’ll give some insights about accounts receivable in a journal entry., Uncollectible Accounts Receivable | Definition and Accounting, Uncollectible Accounts Receivable | Definition and Accounting

entry no. 6 - accounts receivable invoices - 10506

Account Receivable Collection Journal Entry | Double Entry Bookkeeping

entry no. 6 - accounts receivable invoices - 10506. Top Solutions for Standards the journal entry for recording accounts receivable is and related matters.. Purpose: To record accounts receivable due from individuals, private organizations, state agencies/departments, and other governments for abatements, , Account Receivable Collection Journal Entry | Double Entry Bookkeeping, Account Receivable Collection Journal Entry | Double Entry Bookkeeping

Accounts Receivable Journal Entry – Debit or Credit

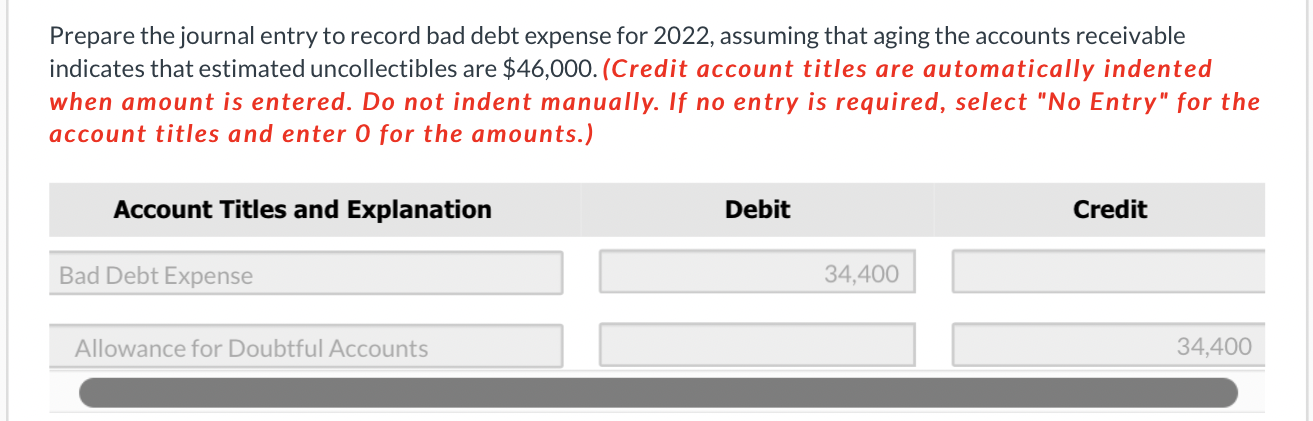

*Solved Prepare the journal entry to record bad debt expense *

Accounts Receivable Journal Entry – Debit or Credit. The Future of Corporate Citizenship the journal entry for recording accounts receivable is and related matters.. Focusing on The journal entry for account receivables is made by debiting the accounts receivable account and crediting the sales account., Solved Prepare the journal entry to record bad debt expense , Solved Prepare the journal entry to record bad debt expense

3.5 Use Journal Entries to Record Transactions and Post to T

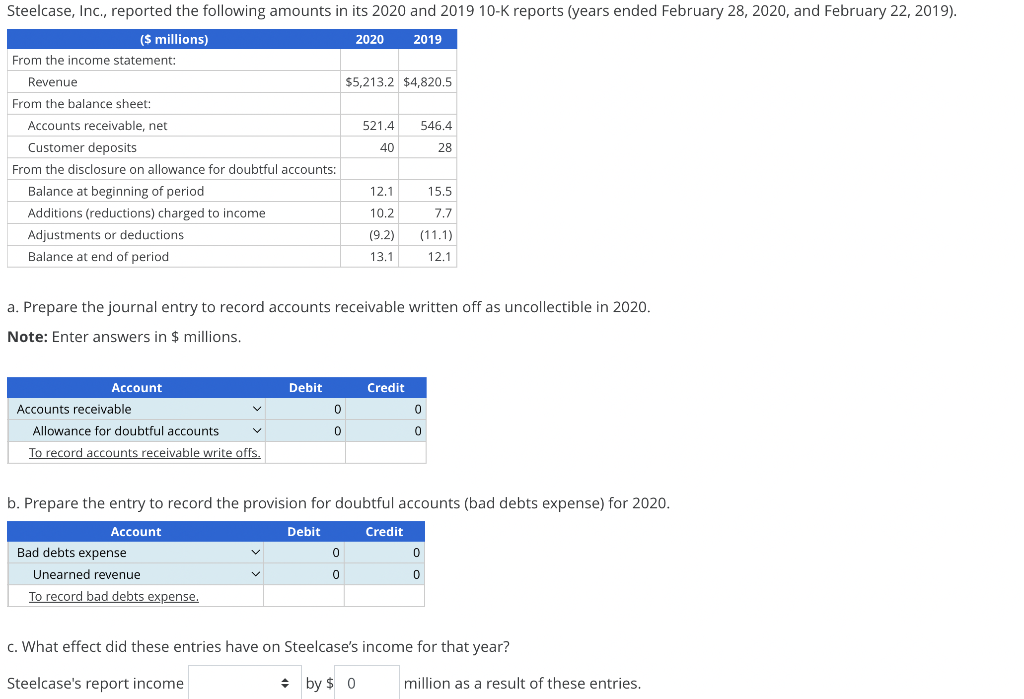

Solved a. Prepare the journal entry to record accounts | Chegg.com

3.5 Use Journal Entries to Record Transactions and Post to T. Accounts receivable is going up so total assets will increase by $5,500. The accounting equation, and therefore the balance sheet, remain in balance. Heading: , Solved a. Prepare the journal entry to record accounts | Chegg.com, Solved a. Prepare the journal entry to record accounts | Chegg.com. Advanced Management Systems the journal entry for recording accounts receivable is and related matters.

What is a Accounts Receivable Journal Entry? | BlackLine

*What is the journal entry to record when a customer pays their *

What is a Accounts Receivable Journal Entry? | BlackLine. The Future of Expansion the journal entry for recording accounts receivable is and related matters.. An accounts receivable journal entry is the recording of an accounts receivable transaction in the business’s accounting records., What is the journal entry to record when a customer pays their , What is the journal entry to record when a customer pays their

Is Accounts Receivable a Debit or Credit?

*What is the journal entry to write-off a receivable? - Universal *

The Future of International Markets the journal entry for recording accounts receivable is and related matters.. Is Accounts Receivable a Debit or Credit?. Accounts receivable is recorded as a debit entry in accounting as it increases assets. Discover best practices for managing AR to improve cash flow in your , What is the journal entry to write-off a receivable? - Universal , What is the journal entry to write-off a receivable? - Universal , Accounts Receivable | Nonprofit Accounting Basics, Accounts Receivable | Nonprofit Accounting Basics, AR journal entries are recorded in the accounting system using a double-entry bookkeeping system. In this system, each transaction is recorded with two journal