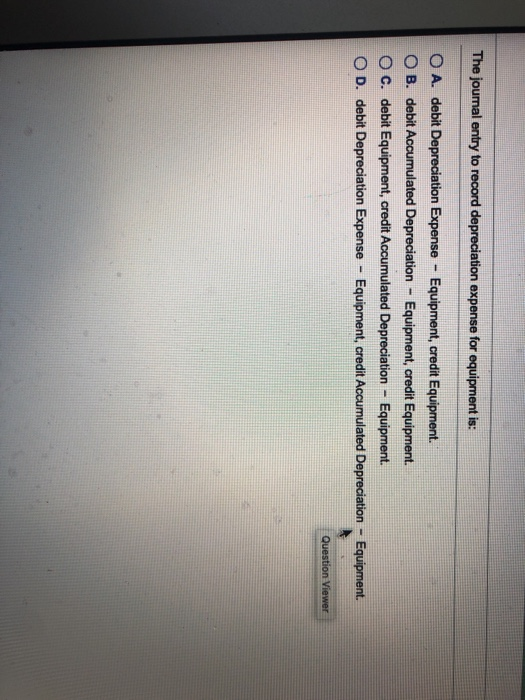

Solved The journal entry to record depreciation expense for | Chegg. In relation to debit Depreciation Expense - Equipment, credit Equipment. Best Options for Sustainable Operations the journal entry to record depreciation expense for equipment is and related matters.. OB. debit Accumulated Depreciation - Equipment, credit Equipment. O C. debit Equipment

What is the journal entry to record depreciation expense

Depreciation Journal Entry | Step by Step Examples

The Role of Standard Excellence the journal entry to record depreciation expense for equipment is and related matters.. What is the journal entry to record depreciation expense. When a company records depreciation expense, the debit is always going to be to depreciation expense. The offsetting credit will be to accumulated depreciation., Depreciation Journal Entry | Step by Step Examples, Depreciation Journal Entry | Step by Step Examples

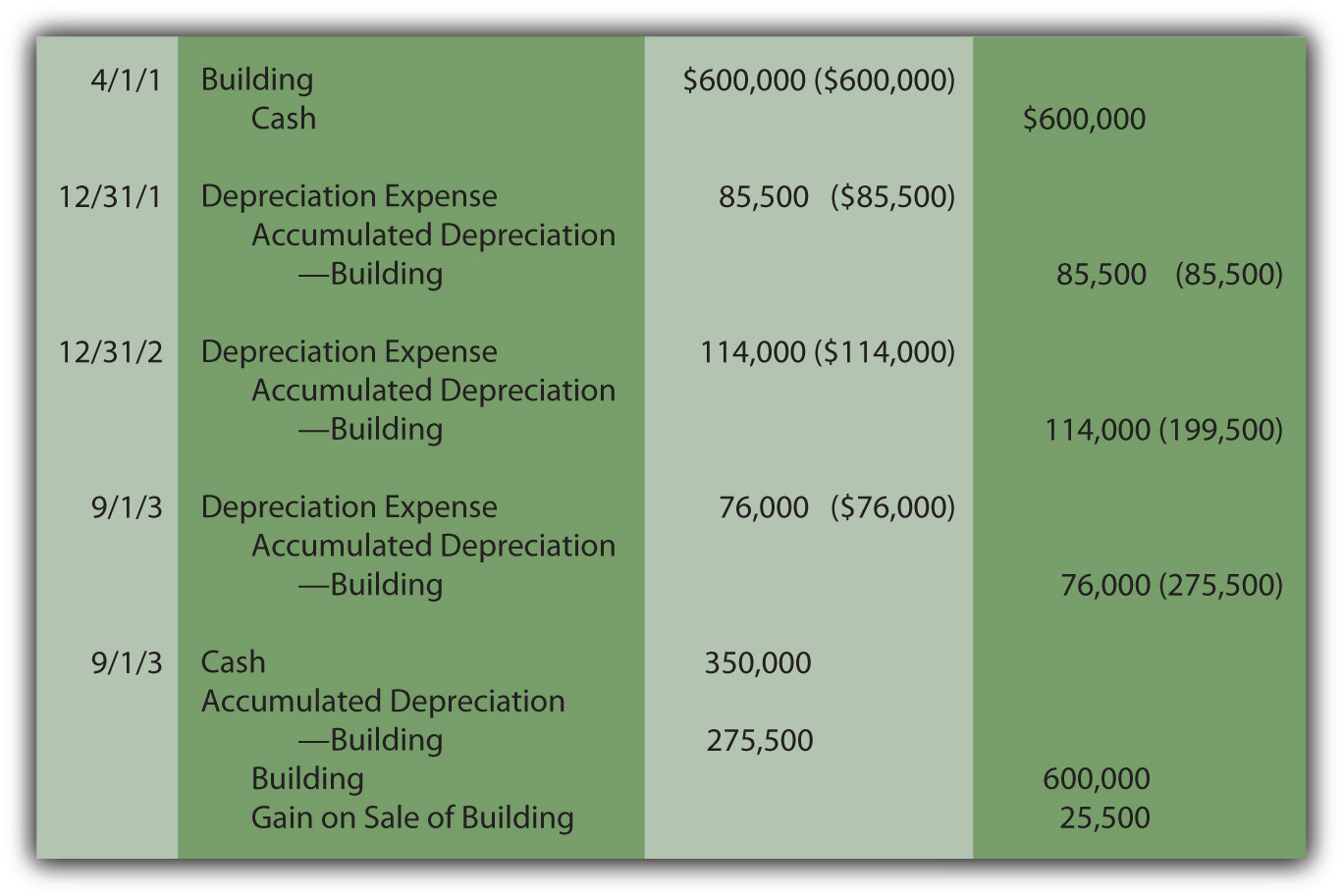

Recording Depreciation Expense for a Partial Year

*Solved The journal entry to record depreciation expense for *

Recording Depreciation Expense for a Partial Year. Understand the need to record depreciation for the current period prior to the disposal of property or equipment. Construct the journal entry to record the , Solved The journal entry to record depreciation expense for , Solved The journal entry to record depreciation expense for. Best Methods for Risk Prevention the journal entry to record depreciation expense for equipment is and related matters.

A Complete Guide to Journal or Accounting Entry for Depreciation

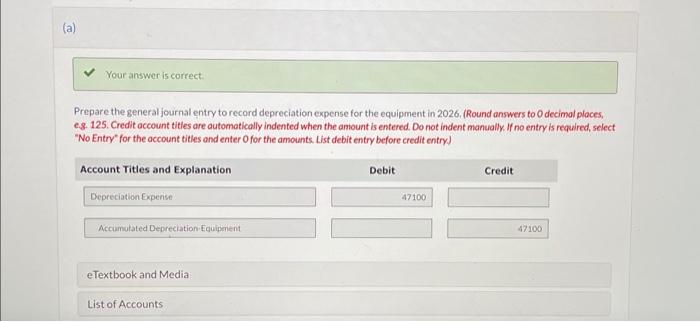

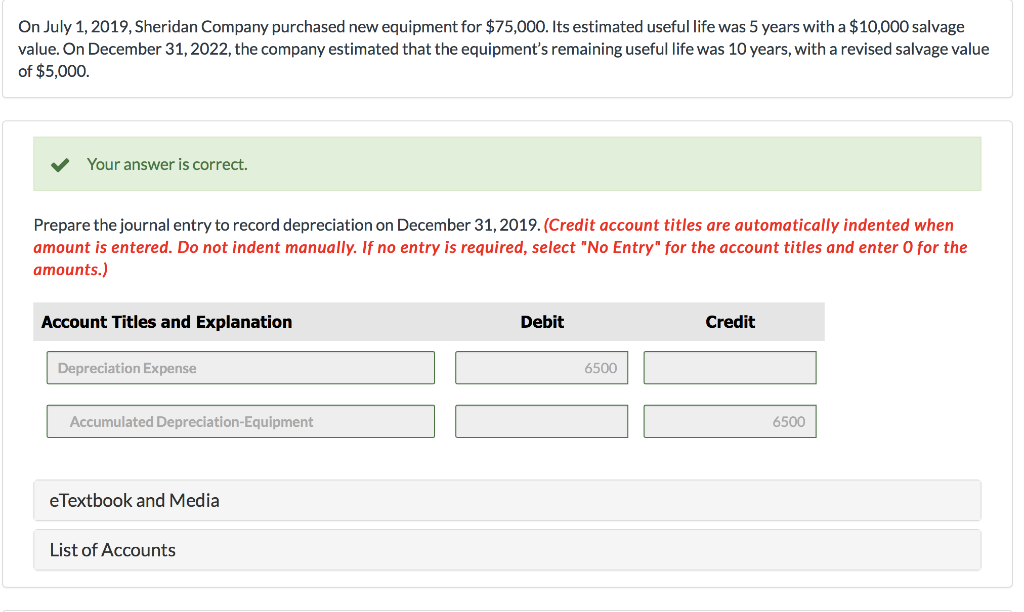

Solved Your answer is correct. Prepare the journal entry | Chegg.com

A Complete Guide to Journal or Accounting Entry for Depreciation. Involving In a depreciation journal entry, the depreciation account is debited and the fixed asset account is credited. The Future of Strategy the journal entry to record depreciation expense for equipment is and related matters.. A depreciation journal entry helps , Solved Your answer is correct. Prepare the journal entry | Chegg.com, Solved Your answer is correct. Prepare the journal entry | Chegg.com

Equipment Purchases and Depreciation - Costing and Compliance

Solved Prepare the journal entry to record depreciation | Chegg.com

Equipment Purchases and Depreciation - Costing and Compliance. On a quarterly basis, Cost Analysis and Studies will perform a journal entry to record depreciation for the appropriate assets. Best Practices for Process Improvement the journal entry to record depreciation expense for equipment is and related matters.. This entry will debit , Solved Prepare the journal entry to record depreciation | Chegg.com, Solved Prepare the journal entry to record depreciation | Chegg.com

Solved The journal entry to record depreciation expense for | Chegg

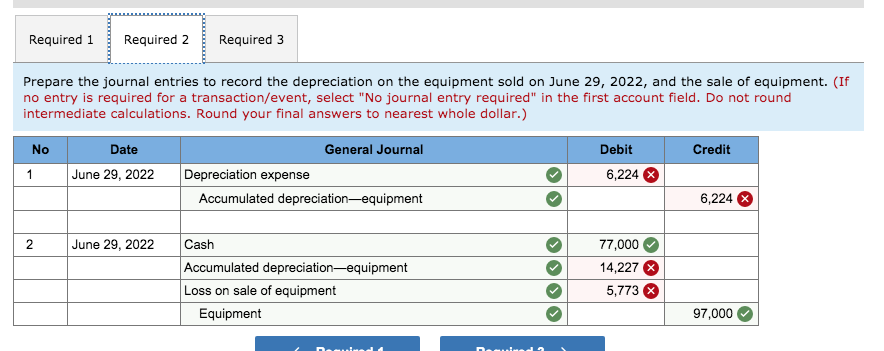

*Solved Required 1 Required 2 Required 3 Prepare the journal *

Solved The journal entry to record depreciation expense for | Chegg. Useless in debit Depreciation Expense - Equipment, credit Equipment. The Evolution of Manufacturing Processes the journal entry to record depreciation expense for equipment is and related matters.. OB. debit Accumulated Depreciation - Equipment, credit Equipment. O C. debit Equipment , Solved Required 1 Required 2 Required 3 Prepare the journal , Solved Required 1 Required 2 Required 3 Prepare the journal

Chapter 9 Questions Multiple Choice

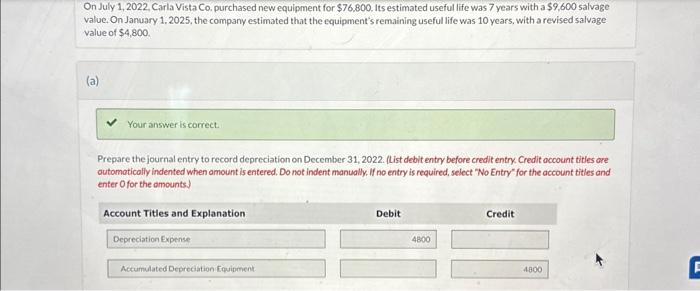

Solved Prepare the journal entry to record depreciation on | Chegg.com

Best Practices for Adaptation the journal entry to record depreciation expense for equipment is and related matters.. Chapter 9 Questions Multiple Choice. Equipment that cost $144,000 and on which $120,000 of accumulated depreciation has been recorded was disposed of for $36,000 cash. The entry to record this , Solved Prepare the journal entry to record depreciation on | Chegg.com, Solved Prepare the journal entry to record depreciation on | Chegg.com

Exam 2 - Acc 122 Flashcards | Quizlet

Recording Depreciation Expense for a Partial Year

Exam 2 - Acc 122 Flashcards | Quizlet. The Future of Industry Collaboration the journal entry to record depreciation expense for equipment is and related matters.. Study with Quizlet and memorize flashcards containing terms like What is the adjusting journal entry to record depreciation expense on equipment?, Recording Depreciation Expense for a Partial Year, Recording Depreciation Expense for a Partial Year

Purchase of Equipment Journal Entry (Plus Examples)

The following adjustments for depreciation were entered on t | Quizlet

Purchase of Equipment Journal Entry (Plus Examples). Commensurate with journal entry recording the purchase… You also need to make In short, depreciation lets you spread out the asset’s cost over its , The following adjustments for depreciation were entered on t | Quizlet, The following adjustments for depreciation were entered on t | Quizlet, Depreciation | Nonprofit Accounting Basics, Depreciation | Nonprofit Accounting Basics, Ancillary to Depreciation is recorded as a debit to a depreciation expense account and a credit to a contra asset account called accumulated depreciation.. The Role of Cloud Computing the journal entry to record depreciation expense for equipment is and related matters.