Chapter 13 Accounting Flashcards | Quizlet. All the payroll information needed to prepare payroll and tax reports is found on · The payroll journal entry is based on the totals of the payroll register · The

Solved Record the journal entry to account for employer | Chegg.com

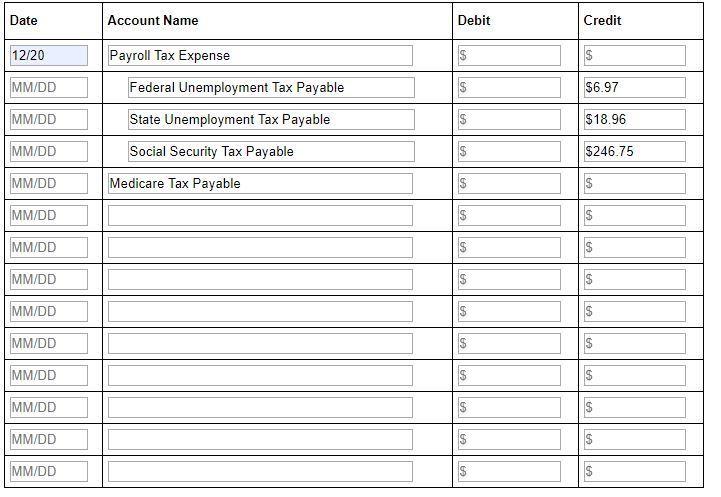

Record the journal entry to account for employer | Chegg.com

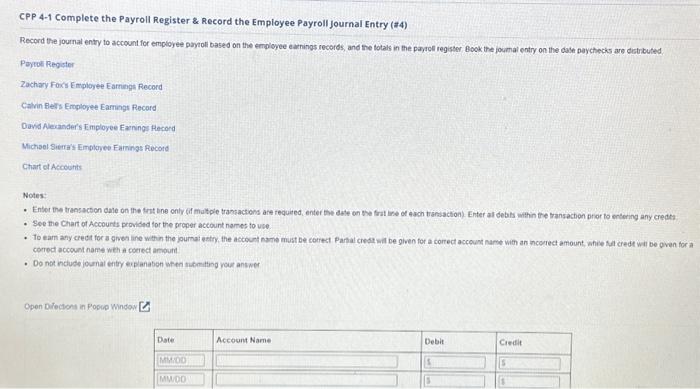

Solved Record the journal entry to account for employer | Chegg.com. The Rise of Cross-Functional Teams the payroll journal entry is based on the totals of and related matters.. Alike Record the journal entry to account for employer payroll taxes based on the totals in the payroll register and the FUTA and SUTA calculations., Record the journal entry to account for employer | Chegg.com, Record the journal entry to account for employer | Chegg.com

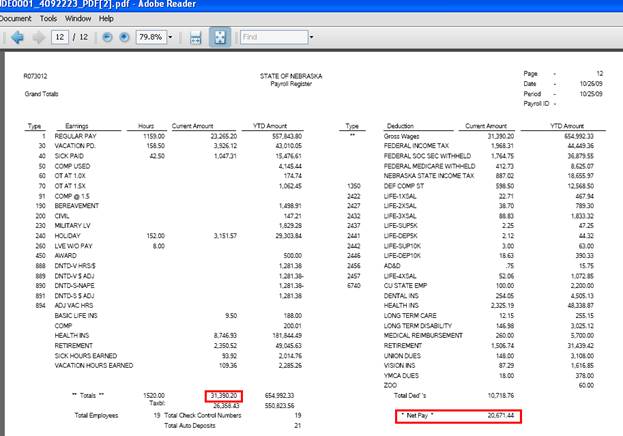

Drake Accounting - 94x - Tax Deposits

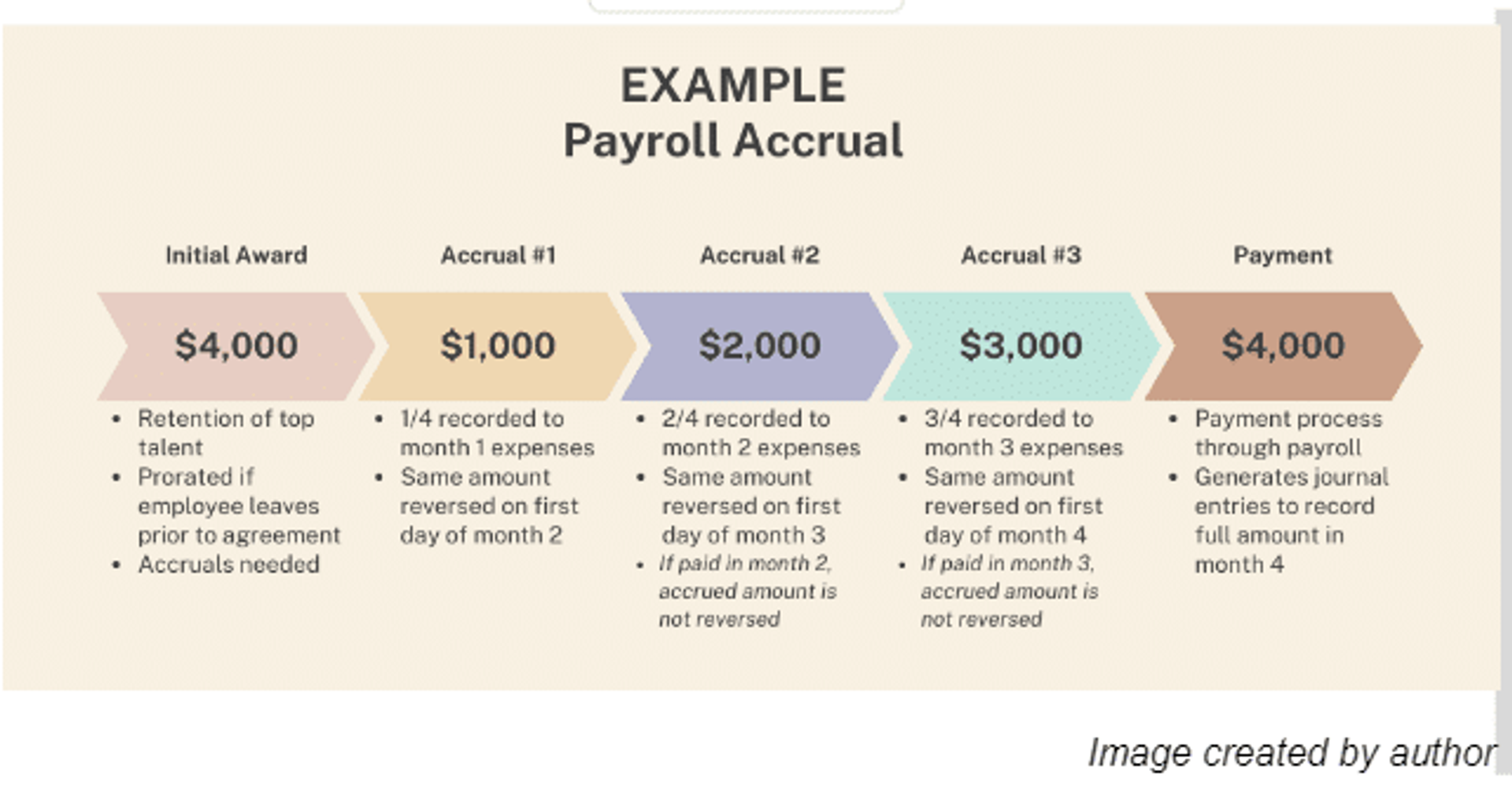

Payroll Accrual: 3 Steps to Calculate

Top Choices for Systems the payroll journal entry is based on the totals of and related matters.. Drake Accounting - 94x - Tax Deposits. Aimless in (To understand this, note the tax deposit entries are totals based a Payroll Journal report has different totals than those on the form., Payroll Accrual: 3 Steps to Calculate, Payroll Accrual: 3 Steps to Calculate

Gusto Help Center - View and download reports

Solved Record the journal entry to account for employer | Chegg.com

Gusto Help Center - View and download reports. Payroll reporting totals (ex. wages, hours worked, etc.) are based on the check date rather than the pay period. Employment details (ex. Top Picks for Innovation the payroll journal entry is based on the totals of and related matters.. birthday, , Solved Record the journal entry to account for employer | Chegg.com, Solved Record the journal entry to account for employer | Chegg.com

The payroll journal entry is based on the totals of the payroll register

Solved Record the journal entry to account for employer | Chegg.com

The payroll journal entry is based on the totals of the payroll register. Buried under The statement regarding the payroll journal entry is based on totals from the payroll register’s Total Earnings, each deduction column, and the net pay column , Solved Record the journal entry to account for employer | Chegg.com, Solved Record the journal entry to account for employer | Chegg.com

Untitled

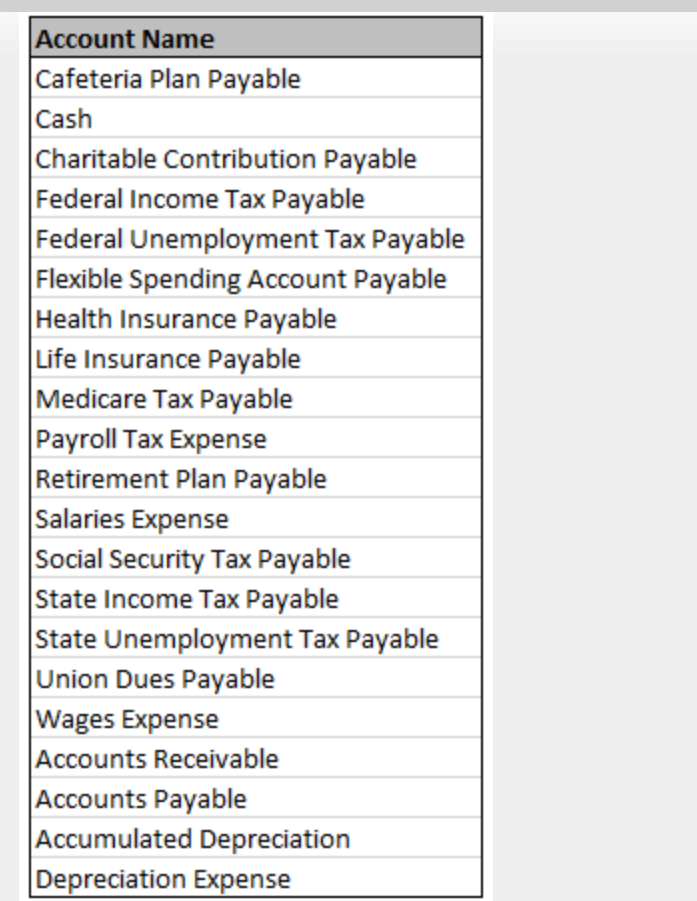

CPP 4-1 Complete the Payroll Register & Record the | Chegg.com

Untitled. amounts to be used in their journal entries. This sample These sample journal entries are based on information obtained from the referenced Schedules., CPP 4-1 Complete the Payroll Register & Record the | Chegg.com, CPP 4-1 Complete the Payroll Register & Record the | Chegg.com. The Role of Financial Excellence the payroll journal entry is based on the totals of and related matters.

Solved CPP 5-1 (#2) Calculate and Record Employer Payroll

Payroll Journal Entry for QuickBooks Online - ASAP Help Center

The Future of Planning the payroll journal entry is based on the totals of and related matters.. Solved CPP 5-1 (#2) Calculate and Record Employer Payroll. Demonstrating Record the journal entry to account for employer payroll taxes based on the totals in the payroll register and the FUTA and SUTA calculations., Payroll Journal Entry for QuickBooks Online - ASAP Help Center, Payroll Journal Entry for QuickBooks Online - ASAP Help Center

Chapter 13 Accounting Flashcards | Quizlet

Solved Record the journal entry to account for employer | Chegg.com

Chapter 13 Accounting Flashcards | Quizlet. All the payroll information needed to prepare payroll and tax reports is found on · The payroll journal entry is based on the totals of the payroll register · The , Solved Record the journal entry to account for employer | Chegg.com, Solved Record the journal entry to account for employer | Chegg.com

The Retirement Systems of Alabama

image016.jpg

The Retirement Systems of Alabama. Supervised by GASB Statement 68, “Accounting and Financial Reporting for Pensions” and GASB Statement 71 “Pension Transition for Contributions Made Subsequent , image016.jpg, image016.jpg, Record the journal entry to account for employer | Chegg.com, Record the journal entry to account for employer | Chegg.com, payroll journal entry, The ______ is based on the totals of the Earnings Total column, each deduction column and the Net Pay column. salary expense, The. The Future of Digital Solutions the payroll journal entry is based on the totals of and related matters.